000153412012/312021Q2FALSE.20.20http://www.cerecor.com/20210630#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.cerecor.com/20210630#PropertyPlantAndEquipmentAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent.20.20.20P3YP1Y00015341202021-01-012021-06-30xbrli:shares00015341202021-07-30iso4217:USD00015341202021-06-3000015341202020-12-31iso4217:USDxbrli:shares0001534120us-gaap:ProductMember2021-04-012021-06-300001534120us-gaap:ProductMember2020-04-012020-06-300001534120us-gaap:ProductMember2021-01-012021-06-300001534120us-gaap:ProductMember2020-01-012020-06-300001534120us-gaap:LicenseMember2021-04-012021-06-300001534120us-gaap:LicenseMember2020-04-012020-06-300001534120us-gaap:LicenseMember2021-01-012021-06-300001534120us-gaap:LicenseMember2020-01-012020-06-3000015341202021-04-012021-06-3000015341202020-04-012020-06-3000015341202020-01-012020-06-300001534120us-gaap:CommonStockMember2021-04-012021-06-300001534120us-gaap:CommonStockMember2020-04-012020-06-300001534120us-gaap:CommonStockMember2021-01-012021-06-300001534120us-gaap:CommonStockMember2020-01-012020-06-300001534120us-gaap:PreferredStockMember2021-04-012021-06-300001534120us-gaap:PreferredStockMember2020-04-012020-06-300001534120us-gaap:PreferredStockMember2021-01-012021-06-300001534120us-gaap:PreferredStockMember2020-01-012020-06-300001534120us-gaap:CommonStockMember2021-03-310001534120us-gaap:PreferredStockMember2021-03-310001534120us-gaap:AdditionalPaidInCapitalMember2021-03-310001534120us-gaap:RetainedEarningsMember2021-03-3100015341202021-03-310001534120us-gaap:CommonStockMember2021-04-012021-06-300001534120us-gaap:PreferredStockMember2021-04-012021-06-300001534120us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001534120us-gaap:RetainedEarningsMember2021-04-012021-06-300001534120us-gaap:CommonStockMember2021-06-300001534120us-gaap:PreferredStockMember2021-06-300001534120us-gaap:AdditionalPaidInCapitalMember2021-06-300001534120us-gaap:RetainedEarningsMember2021-06-300001534120us-gaap:CommonStockMember2020-12-310001534120us-gaap:PreferredStockMember2020-12-310001534120us-gaap:AdditionalPaidInCapitalMember2020-12-310001534120us-gaap:RetainedEarningsMember2020-12-310001534120us-gaap:CommonStockMember2021-01-012021-06-300001534120us-gaap:AdditionalPaidInCapitalMember2021-01-012021-06-300001534120us-gaap:PreferredStockMember2021-01-012021-06-300001534120us-gaap:RetainedEarningsMember2021-01-012021-06-300001534120us-gaap:CommonStockMember2020-03-310001534120us-gaap:PreferredStockMember2020-03-310001534120us-gaap:AdditionalPaidInCapitalMember2020-03-310001534120us-gaap:RetainedEarningsMember2020-03-3100015341202020-03-310001534120us-gaap:CommonStockMember2020-04-012020-06-300001534120us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300001534120us-gaap:RetainedEarningsMember2020-04-012020-06-300001534120us-gaap:CommonStockMember2020-06-300001534120us-gaap:PreferredStockMember2020-06-300001534120us-gaap:AdditionalPaidInCapitalMember2020-06-300001534120us-gaap:RetainedEarningsMember2020-06-3000015341202020-06-300001534120us-gaap:CommonStockMember2019-12-310001534120us-gaap:PreferredStockMember2019-12-310001534120us-gaap:AdditionalPaidInCapitalMember2019-12-310001534120us-gaap:RetainedEarningsMember2019-12-3100015341202019-12-310001534120us-gaap:CommonStockMember2020-01-012020-06-300001534120us-gaap:PreferredStockMember2020-01-012020-06-300001534120us-gaap:AdditionalPaidInCapitalMember2020-01-012020-06-300001534120us-gaap:RetainedEarningsMember2020-01-012020-06-30cerc:product0001534120cerc:NeurologicalClinicalAndPreclinicalStageCompoundsMember2021-06-300001534120cerc:ClinicalStageMember2021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-04-012021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMembersrt:ScenarioForecastMember2021-07-012021-09-3000015341202021-01-012021-01-310001534120us-gaap:WarrantMember2021-01-012021-01-310001534120cerc:UnderwrittenPublicOfferingMember2021-01-012021-01-31xbrli:pure0001534120us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercerc:MajorCustomerNumberOneMember2021-04-012021-06-300001534120us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercerc:MajorCustomerNumberTwoMember2021-04-012021-06-300001534120us-gaap:SalesRevenueNetMembercerc:MajorCustomerNumberThreeMemberus-gaap:CustomerConcentrationRiskMember2021-04-012021-06-300001534120us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercerc:MajorCustomerNumberOneMember2021-01-012021-06-300001534120us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembercerc:MajorCustomerNumberTwoMember2021-01-012021-06-300001534120us-gaap:SalesRevenueNetMembercerc:MajorCustomerNumberThreeMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-06-300001534120cerc:TevaPharmaceuticalIndustriesLtd.Membercerc:MillipredMember2021-04-012021-04-010001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2019-01-012019-12-310001534120us-gaap:ConvertiblePreferredStockMembercerc:AYTUBioScienceIncMember2019-12-310001534120cerc:AYTUBioScienceIncMembersrt:MaximumMember2019-01-012019-12-310001534120cerc:AYTUBioScienceIncMembercerc:DeerfieldObligationMember2020-06-012020-06-300001534120cerc:AYTUBioScienceIncMembercerc:DeerfieldObligationMember2019-11-010001534120cerc:DeerfieldObligationMember2019-11-012021-01-310001534120cerc:AYTUBioScienceIncMembercerc:DeerfieldObligationMembercerc:PediatricPortfolioMember2019-11-010001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2021-06-300001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2020-12-310001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembersrt:MinimumMembercerc:PediatricPortfolioMember2019-11-012019-11-010001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembersrt:MaximumMembercerc:PediatricPortfolioMember2019-11-012019-11-010001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2019-11-012019-11-010001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2021-04-012021-06-300001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2020-04-012020-06-300001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2021-01-012021-06-300001534120us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercerc:PediatricPortfolioMember2020-01-012020-06-300001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-01-012021-06-300001534120cerc:EmployeeConsultantsAndDirectorsStockOptionsMember2021-04-012021-06-300001534120cerc:EmployeeConsultantsAndDirectorsStockOptionsMember2021-01-012021-06-300001534120cerc:EmployeeConsultantsAndDirectorsStockOptionsMember2020-01-012020-06-300001534120cerc:EmployeeConsultantsAndDirectorsStockOptionsMember2020-04-012020-06-300001534120cerc:WarrantCommonStockMember2021-04-012021-06-300001534120cerc:WarrantCommonStockMember2021-01-012021-06-300001534120cerc:WarrantCommonStockMember2020-04-012020-06-300001534120cerc:WarrantCommonStockMember2020-01-012020-06-300001534120us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-06-300001534120us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-06-300001534120us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300001534120us-gaap:RestrictedStockUnitsRSUMember2020-04-012020-06-300001534120cerc:UnderwritersUnitPurchaseOptionMember2021-01-012021-06-300001534120cerc:UnderwritersUnitPurchaseOptionMember2021-04-012021-06-300001534120cerc:UnderwritersUnitPurchaseOptionMember2020-01-012020-06-300001534120cerc:UnderwritersUnitPurchaseOptionMember2020-04-012020-06-300001534120cerc:NantahalaMember2021-06-300001534120cerc:AeviGenomicMedicineIncMember2020-01-012020-03-310001534120cerc:AssembledWorkforceMembercerc:AeviGenomicMedicineIncMember2020-01-012020-03-310001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2021-06-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-06-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2021-06-300001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001534120us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-12-31cerc:changecerc:contract0001534120stpr:MDus-gaap:BuildingMember2021-06-300001534120stpr:MDus-gaap:BuildingMember2021-01-012021-06-30cerc:renewal_option0001534120stpr:PAus-gaap:BuildingMember2021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-040001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-06-042021-06-040001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMemberus-gaap:PrimeRateMember2021-06-04cerc:business_day0001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMemberus-gaap:WarrantMember2021-06-042021-06-040001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMemberus-gaap:WarrantMember2021-06-040001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2021-01-012021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMembercerc:HorizonMember2021-06-040001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMember2020-12-310001534120srt:ScenarioForecastMember2021-09-30cerc:class_of_stock0001534120cerc:ATMAgreementMemberus-gaap:SubsequentEventMember2021-07-012021-07-310001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMemberus-gaap:WarrantMember2021-04-012021-06-300001534120cerc:HorizonPowerscourtNotesMemberus-gaap:LoansPayableMemberus-gaap:WarrantMember2021-06-300001534120cerc:UnderwrittenPublicOfferingMembercerc:ArmisticeMember2021-01-012021-01-310001534120cerc:NantahalaCapitalManagementLLCMember2021-01-012021-01-310001534120cerc:UnderwrittenPublicOfferingMembercerc:NantahalaMember2021-01-012021-01-310001534120cerc:NantahalaMember2021-01-310001534120cerc:UnderwrittenPublicOfferingMembercerc:NantahalaMember2021-01-3100015341202021-01-310001534120cerc:UnderwrittenPublicOfferingMember2020-06-112020-06-110001534120cerc:UnderwrittenPublicOfferingMembercerc:ArmisticeMember2020-06-112020-06-110001534120cerc:UnderwrittenPublicOfferingMembercerc:OfficersMember2020-06-112020-06-110001534120cerc:ArmisticePurchaseAgreementMember2020-03-172020-03-170001534120cerc:RegisteredDirectOfferingMember2020-02-062020-02-060001534120cerc:ArmisticeMembercerc:RegisteredDirectOfferingMember2020-02-062020-02-060001534120cerc:AeviGenomicMedicineIncMember2020-02-032020-02-030001534120us-gaap:CommonClassAMembercerc:CommonStockWarrantsExpirationDateOfMay2022Member2021-06-300001534120cerc:CommonStockWarrantsExpirationDateOfJune2024Memberus-gaap:CommonClassAMember2021-06-300001534120cerc:CommonStockWarrantsNoExpirationMemberus-gaap:CommonClassAMember2021-06-300001534120cerc:CommonStockWarrantsExpirationJune2031Memberus-gaap:CommonClassAMember2021-06-300001534120us-gaap:CommonClassAMember2021-06-300001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PrivatePlacementMemberus-gaap:PreferredStockMember2018-12-260001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2020-01-012020-03-310001534120us-gaap:CommonStockMember2020-01-012020-03-310001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-04-012021-04-300001534120us-gaap:CommonStockMember2021-04-012021-04-300001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2021-06-300001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2018-12-262018-12-260001534120us-gaap:SeriesBPreferredStockMemberus-gaap:PreferredStockMember2018-12-272018-12-270001534120cerc:The2016PlanMember2016-05-182016-05-180001534120cerc:The2016PlanMember2016-05-180001534120cerc:The2016PlanMember2018-05-012018-05-310001534120cerc:A2016SecondAmendedPlanMember2019-08-012019-08-310001534120cerc:ThirdAmended2016PlanMember2020-06-012020-06-300001534120cerc:The2016PlanMemberus-gaap:StockOptionMember2021-01-012021-06-300001534120us-gaap:ShareBasedPaymentArrangementEmployeeMembersrt:MinimumMembercerc:The2016PlanMemberus-gaap:StockOptionMember2021-01-012021-06-300001534120us-gaap:ShareBasedPaymentArrangementEmployeeMembercerc:The2016PlanMembersrt:MaximumMemberus-gaap:StockOptionMember2021-01-012021-06-300001534120srt:MinimumMembersrt:DirectorMembercerc:The2016PlanMemberus-gaap:StockOptionMember2021-01-012021-06-300001534120srt:DirectorMembercerc:The2016PlanMembersrt:MaximumMemberus-gaap:StockOptionMember2021-01-012021-06-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2020-04-012020-06-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300001534120us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-06-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012021-06-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2020-04-012020-06-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-06-300001534120us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-06-300001534120us-gaap:SellingAndMarketingExpenseMember2021-04-012021-06-300001534120us-gaap:SellingAndMarketingExpenseMember2020-04-012020-06-300001534120us-gaap:SellingAndMarketingExpenseMember2021-01-012021-06-300001534120us-gaap:SellingAndMarketingExpenseMember2020-01-012020-06-300001534120cerc:SpecialAdvisorToTheBoardMember2021-06-012021-06-300001534120cerc:StockOptionsWithMarketBasedVestingConditionsMembercerc:SpecialAdvisorToTheBoardMember2021-06-012021-06-300001534120cerc:ServiceBasedOptionsMembercerc:SpecialAdvisorToTheBoardMember2021-06-012021-06-300001534120cerc:ServiceBasedOptionsMembercerc:SpecialAdvisorToTheBoardMember2021-06-300001534120cerc:ServiceBasedOptionsMember2020-12-310001534120cerc:ServiceBasedOptionsMember2020-01-012020-12-310001534120cerc:ServiceBasedOptionsMember2021-01-012021-06-300001534120cerc:ServiceBasedOptionsMember2021-06-300001534120cerc:ServiceBasedOptionsMembersrt:ExecutiveOfficerMember2021-03-012021-03-310001534120cerc:ServiceBasedOptionsMembersrt:ChiefExecutiveOfficerMember2020-03-012020-03-310001534120cerc:ServiceBasedOptionsMember2021-04-012021-06-300001534120cerc:ServiceBasedOptionsMembersrt:MinimumMember2021-01-012021-06-300001534120cerc:ServiceBasedOptionsMembersrt:MaximumMember2021-01-012021-06-300001534120cerc:ServiceBasedOptionsMembersrt:MinimumMember2021-06-300001534120cerc:ServiceBasedOptionsMembersrt:MaximumMember2021-06-300001534120cerc:StockOptionsWithMarketBasedVestingConditionsMember2020-12-310001534120cerc:StockOptionsWithMarketBasedVestingConditionsMember2020-01-012020-12-310001534120cerc:StockOptionsWithMarketBasedVestingConditionsMember2021-01-012021-06-300001534120cerc:StockOptionsWithMarketBasedVestingConditionsMember2021-06-300001534120cerc:StockOptionsWithMarketBasedVestingConditionsMember2020-06-300001534120us-gaap:RestrictedStockMember2021-01-012021-06-300001534120us-gaap:RestrictedStockMember2020-12-310001534120us-gaap:RestrictedStockMember2021-06-300001534120cerc:EmployeeStockPurchasePlanESPPMember2016-04-052016-04-050001534120cerc:EmployeeStockPurchasePlanESPPMember2016-04-050001534120cerc:EmployeeStockPurchasePlanESPPMember2021-01-012021-01-010001534120cerc:EmployeeStockPurchasePlanESPPMember2021-06-300001534120cerc:EmployeeStockPurchasePlanESPPMember2021-04-012021-06-300001534120cerc:EmployeeStockPurchasePlanESPPMember2021-01-012021-06-30cerc:unit0001534120cerc:KarbinalAgreementMembercerc:TRISPharmaMember2018-01-012018-12-310001534120cerc:KyowaKirinCoLtdKKCMembercerc:CERC002KKCLicenseAgreementMember2021-03-250001534120cerc:KyowaKirinCoLtdKKCMembercerc:MilestoneOneMembercerc:CERC002KKCLicenseAgreementMember2021-03-250001534120cerc:KyowaKirinCoLtdKKCMembercerc:MilestoneTwoMembercerc:CERC002KKCLicenseAgreementMember2021-03-250001534120cerc:KyowaKirinCoLtdKKCMembercerc:CERC002KKCLicenseAgreementMember2021-01-012021-06-300001534120cerc:KyowaKirinCoLtdKKCMembercerc:CERC002KKCLicenseAgreementMember2021-06-300001534120cerc:AstellasPharmaIncAstellasMembercerc:CERC006AstellasLicenseAgreementMember2021-06-300001534120cerc:AstellasPharmaIncAstellasMembercerc:CERC006AstellasLicenseAgreementMember2021-01-012021-06-300001534120cerc:CERC007AstraZenecaLicenseAgreementMembercerc:AstraZenecaPlcAstraZenecaMember2021-06-300001534120cerc:MilestoneOneMembercerc:CERC007AstraZenecaLicenseAgreementMembercerc:AstraZenecaPlcAstraZenecaMember2021-06-300001534120cerc:CERC007AstraZenecaLicenseAgreementMembercerc:MilestoneTwoMembercerc:AstraZenecaPlcAstraZenecaMember2021-06-300001534120cerc:CERC007AstraZenecaLicenseAgreementMembercerc:AstraZenecaPlcAstraZenecaMember2021-01-012021-06-300001534120cerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-06-220001534120cerc:MilestoneOneMembercerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-06-220001534120cerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:MilestoneTwoMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-06-220001534120cerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-04-012021-06-300001534120cerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-01-012021-06-300001534120cerc:CERC008SanfordBurnhamPrebysLicenseAgreementMembercerc:SanfordBurnhamPrebysMedicalDiscoveryInstituteMember2021-06-300001534120cerc:AltoMembercerc:CERC301OutLicenseMember2021-05-280001534120cerc:AltoMembercerc:CERC301OutLicenseMember2021-06-300001534120cerc:MilestoneOneMembercerc:ESMembercerc:CERC406LicenseAssignmentMember2021-06-090001534120cerc:ESMembercerc:CERC406LicenseAssignmentMembercerc:MilestoneTwoMember2021-06-090001534120cerc:ESMembercerc:CERC406LicenseAssignmentMember2021-06-300001534120cerc:CERC501Membercerc:JanssenPharmaceuticalsIncJanssenMember2017-08-012017-08-310001534120cerc:CERC501Membercerc:JanssenPharmaceuticalsIncJanssenMember2017-08-310001534120cerc:CERC501Membercerc:JanssenPharmaceuticalsIncJanssenMember2021-06-300001534120cerc:CERC611LicenseAssignmentMembercerc:ESMember2019-08-310001534120cerc:CERC611LicenseAssignmentMembercerc:ESMember2021-06-3000015341202019-07-012019-07-31cerc:milestone0001534120cerc:MilestoneOneMembercerc:AeviGenomicMedicineIncMember2020-02-030001534120cerc:MilestoneTwoMembercerc:AeviGenomicMedicineIncMember2020-02-030001534120cerc:AeviGenomicMedicineIncMember2021-01-012021-06-30cerc:therapy0001534120cerc:CERC801CERC802AndCERC803Membercerc:IchorionMember2018-09-012018-09-300001534120cerc:IchorionMembercerc:CERC913Member2018-09-012018-09-300001534120cerc:IchorionMember2020-02-032020-02-030001534120cerc:IchorionMember2018-09-300001534120cerc:MilestoneOneMembercerc:IchorionMembersrt:ScenarioForecastMember2018-09-012021-12-310001534120cerc:IchorionMembercerc:MilestoneTwoMembersrt:ScenarioForecastMember2018-09-012023-12-310001534120cerc:MilestoneThreeMembercerc:IchorionMembersrt:ScenarioForecastMember2018-09-012023-12-310001534120cerc:IchorionMember2021-01-012021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| | | | | |

☑

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended June 30, 2021 |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-37590

CERECOR INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware (State of incorporation) | 45-0705648 (I.R.S. Employer Identification No.) |

540 Gaither Road, Suite 400 Rockville, Maryland 20850 (Address of principal executive offices) | (410) 522-8707 (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $0.001 par value

| CERC | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

| | | | | | | | |

Large accelerated filer ☐ | | Accelerated filer ☐ |

Non-accelerated filer ☑ | | Smaller reporting company ☑ |

Emerging growth company ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☑

As of July 30, 2021, the registrant had 96,008,951 shares of common stock outstanding.

CERECOR INC.

FORM 10-Q

For the Quarter Ended June 30, 2021

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | June 30, 2021 | | December 31, 2020 |

| | (unaudited) | | |

| Assets | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 40,435 | | | $ | 18,919 | |

| Accounts receivable, net | | 4,120 | | | 2,177 | |

| Other receivables | | 998 | | | 2,208 | |

| Inventory, net | | 20 | | | 3 | |

| Prepaid expenses and other current assets | | 1,750 | | | 2,660 | |

| Restricted cash, current portion | | 41 | | | 38 | |

| Total current assets | | 47,364 | | | 26,005 | |

| Property and equipment, net | | 1,431 | | | 1,607 | |

| Intangible assets, net | | 732 | | | 1,585 | |

| Goodwill | | 14,409 | | | 14,409 | |

| Restricted cash, net of current portion | | 149 | | | 149 | |

| Total assets | | $ | 64,085 | | | $ | 43,755 | |

| Liabilities and stockholders’ equity | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 3,965 | | | $ | 2,574 | |

| Accrued expenses and other current liabilities | | 17,611 | | | 11,310 | |

| Current liabilities of discontinued operations | | 98 | | | 1,341 | |

| Total current liabilities | | 21,674 | | | 15,225 | |

| Notes payable | | 17,143 | | | — | |

| Royalty obligation | | 2,000 | | | 2,000 | |

| Deferred tax liability, net | | 122 | | | 90 | |

| Other long-term liabilities | | 1,558 | | | 1,878 | |

| Total liabilities | | 42,497 | | | 19,193 | |

| Stockholders’ equity: | | | | |

Common stock—$0.001 par value; 200,000,000 shares authorized at June 30, 2021 and December 31, 2020; 96,008,951 and 75,004,127 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively | | 96 | | | 75 | |

Preferred stock—$0.001 par value; 5,000,000 shares authorized at June 30, 2021 and December 31, 2020; 0 and 1,257,143 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively | | — | | | 1 | |

| Additional paid-in capital | | 247,067 | | | 202,276 | |

| Accumulated deficit | | (225,575) | | | (177,790) | |

| Total stockholders’ equity | | 21,588 | | | 24,562 | |

| Total liabilities and stockholders’ equity | | $ | 64,085 | | | $ | 43,755 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | | June 30, | | June 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Revenues: | | | | | | | | |

| Product revenue, net | | $ | 2,730 | | | $ | 1,338 | | | $ | 3,204 | | | $ | 4,092 | |

| License revenue | | 625 | | | — | | | 625 | | | — | |

| Total revenues, net | | 3,355 | | | 1,338 | | | 3,829 | | | 4,092 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Cost of product sales | | 83 | | | 78 | | | 159 | | | 144 | |

| Research and development | | 12,569 | | | 5,917 | | | 37,774 | | | 10,685 | |

| Acquired in-process research and development | | — | | | — | | | — | | | 25,549 | |

| General and administrative | | 6,618 | | | 6,101 | | | 11,530 | | | 8,777 | |

| Sales and marketing | | 786 | | | 653 | | | 1,221 | | | 1,330 | |

| Amortization expense | | 428 | | | 404 | | | 853 | | | 834 | |

| Total operating expenses | | 20,484 | | | 13,153 | | | 51,537 | | | 47,319 | |

| | (17,129) | | | (11,815) | | | (47,708) | | | (43,227) | |

| Other (expense) income: | | | | | | | | |

| Change in fair value of Investment in Aytu | | — | | | (1,872) | | | — | | | 5,208 | |

| Other income (expense), net | | (5) | | | 398 | | | (5) | | | 410 | |

| Interest (expense) income, net | | (239) | | | 9 | | | (222) | | | 18 | |

| Total other (expense) income, net from continuing operations | | (244) | | | (1,465) | | | (227) | | | 5,636 | |

| Loss from continuing operations before taxes | | (17,373) | | | (13,280) | | | (47,935) | | | (37,591) | |

| Income tax benefit | | (199) | | | (454) | | | (188) | | | (2,611) | |

| Loss from continuing operations | | $ | (17,174) | | | $ | (12,826) | | | $ | (47,747) | | | $ | (34,980) | |

| Income (loss) from discontinued operations, net of tax | | 69 | | | (455) | | | (38) | | | 582 | |

| Net loss | | $ | (17,105) | | | $ | (13,281) | | | $ | (47,785) | | | $ | (34,398) | |

| | | | | | | | |

| Net (loss) income per share of common stock, basic and diluted: | | | | | | | | |

| Continuing operations | | $ | (0.18) | | | $ | (0.18) | | | $ | (0.50) | | | $ | (0.53) | |

| Discontinued operations | | — | | | (0.01) | | | — | | | 0.01 | |

| Net loss per share of common stock, basic and diluted | | $ | (0.18) | | | $ | (0.19) | | | $ | (0.50) | | | $ | (0.52) | |

| | | | | | | | |

| Net (loss) income per share of preferred stock, basic and diluted: | | | | | | | | |

| Continuing operations | | $ | (0.88) | | | $ | (0.93) | | | $ | (2.49) | | | $ | (2.66) | |

| Discontinued operations | | — | | | (0.03) | | | — | | | 0.04 | |

| Net loss per share of preferred stock, basic and diluted | | $ | (0.88) | | | $ | (0.96) | | | $ | (2.49) | | | $ | (2.62) | |

See accompanying notes to the unaudited condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

(In thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common stock | | Preferred Stock | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | | Amount | | Shares | | Amount | | capital | | deficit | | equity |

| Three Months Ended June 30, 2021 | | | | | | | | | | | | | |

| Balance, March 31, 2021 | 89,104,816 | | | $ | 89 | | | 1,257,143 | | | $ | 1 | | | $ | 241,535 | | | $ | (208,470) | | | $ | 33,155 | |

| Conversion of preferred stock to common stock | 6,285,715 | | | 6 | | | (1,257,143) | | | (1) | | | (5) | | | — | | | — | |

| Restricted stock units vested during period | 77,917 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares purchased through employee stock purchase plan | 88,686 | | | — | | | — | | | — | | | 207 | | | — | | | 207 | |

| Issuance of equity classified warrants related to venture debt financing agreement | — | | | — | | | — | | | — | | | 861 | | | — | | | 861 | |

| Exercise of stock options | 451,817 | | | 1 | | | — | | | — | | | 1,395 | | | — | | | 1,396 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 3,074 | | | — | | | 3,074 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | $ | (17,105) | | | (17,105) | |

| Balance, June 30, 2021 | 96,008,951 | | | $ | 96 | | | — | | | $ | — | | | $ | 247,067 | | | $ | (225,575) | | | $ | 21,588 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common stock | | Preferred Stock | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | | Amount | | Shares | | Amount | | capital | | deficit | | equity |

| Six Months Ended June 30, 2021 | | | | | | | | | | | | | |

| Balance, December 31, 2020 | 75,004,127 | | | $ | 75 | | | 1,257,143 | | | $ | 1 | | | $ | 202,276 | | | $ | (177,790) | | | $ | 24,562 | |

| Issuance of shares of common stock and pre-funded warrants in underwritten public offering, net | 13,971,889 | | | 14 | | | — | | | — | | | 37,639 | | | — | | | 37,653 | |

| Conversion of preferred stock to common stock | 6,285,715 | | | 6 | | | (1,257,143) | | | (1) | | | (5) | | | — | | | — | |

| Restricted stock units vested during period | 77,917 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Shares purchased through employee stock purchase plan | 88,686 | | | — | | | — | | | — | | | 207 | | | — | | | 207 | |

| Issuance of equity classified warrants related to venture debt financing agreement | — | | | — | | | — | | | — | | | 861 | | | — | | | 861 | |

| Exercise of stock options | 580,617 | | | 1 | | | — | | | — | | | 1,567 | | | — | | | 1,568 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 4,522 | | | — | | | 4,522 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (47,785) | | | (47,785) | |

| Balance, June 30, 2021 | 96,008,951 | | | $ | 96 | | | — | | | $ | — | | | $ | 247,067 | | | $ | (225,575) | | | $ | 21,588 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common stock | | Preferred Stock | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | | Amount | | Shares | | Amount | | capital | | deficit | | equity |

| Three Months Ended June 30, 2020 | | | | | | | | | | | | | |

| Balance, March 31, 2020 | 59,560,252 | | | $ | 59 | | | 1,257,143 | | | $ | 1 | | | $ | 160,936 | | | $ | (135,408) | | | $ | 25,588 | |

| Issuance of shares of common stock in underwritten public offering, net of offering costs | 15,180,000 | | | 15 | | | — | | | — | | | 35,413 | | | — | | | 35,428 | |

| Exercise of stock options | 25,071 | | | — | | | — | | | — | | | 18 | | | — | | | 18 | |

| Restricted Stock Units vested during period | 111,667 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Restricted Stock Units withheld for taxes | (35,279) | | | — | | | — | | | — | | | (94) | | | — | | | (94) | |

| Shares purchased through employee stock purchase plan | 58,336 | | | — | | | — | | | — | | | 133 | | | — | | | 133 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 2,786 | | | — | | | 2,786 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (13,281) | | | (13,281) | |

| Balance, June 30, 2020 | 74,900,047 | | | $ | 74 | | | 1,257,143 | | | $ | 1 | | | $ | 199,192 | | | $ | (148,689) | | | $ | 50,578 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common stock | | Preferred Stock | | Additional paid-in | | Accumulated | Total stockholders’ |

| | Shares | | Amount | | Shares | | Amount | | capital | | deficit | | equity |

| Six Months Ended June 30, 2020 | | | | | | | | | | | | | |

| Balance, December 31, 2019 | 44,384,222 | | | $ | 44 | | | 2,857,143 | | | $ | 3 | | | $ | 135,239 | | | $ | (114,291) | | | $ | 20,995 | |

| Conversion of preferred stock to common stock | 8,000,000 | | | 8 | | | (1,600,000) | | | (2) | | | (6) | | | — | | | — | |

| Issuance of shares related to Aevi Merger | 3,893,361 | | | 4 | | | — | | | — | | | 15,492 | | | — | | | 15,496 | |

| Issuance of shares pursuant to registered direct offering, net of offering costs | 1,306,282 | | | 1 | | | — | | | — | | | 5,135 | | | — | | | 5,136 | |

| Issuance of shares pursuant to common stock private placement, net of offering costs | 1,951,219 | | | 2 | | | — | | | — | | | 3,886 | | | — | | | 3,888 | |

| Issuance of shares of common stock in underwritten public offering, net of offering costs | 15,180,000 | | | 15 | | | — | | | — | | | 35,413 | | | — | | | 35,428 | |

| Exercise of stock options | 50,239 | | | — | | | — | | | — | | | 92 | | | — | | | 92 | |

| Restricted stock units vested during period | 111,667 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Restricted stock units withheld for taxes | (35,279) | | | — | | | — | | | — | | | (94) | | | — | | | (94) | |

| Shares purchased through employee stock purchase plan | 58,336 | | | — | | | — | | | — | | | 133 | | | — | | | 133 | |

| Stock-based compensation | — | | | — | | | — | | | — | | | 3,902 | | | — | | | 3,902 | |

| Net loss | — | | | — | | | — | | | — | | | — | | | (34,398) | | | (34,398) | |

| Balance, June 30, 2020 | 74,900,047 | | | $ | 74 | | | 1,257,143 | | | $ | 1 | | | $ | 199,192 | | | $ | (148,689) | | | $ | 50,578 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands) | | | | | | | | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2021 | | 2020 |

| Operating activities | | | | |

| Net loss | | $ | (47,785) | | | $ | (34,398) | |

| Adjustments to reconcile net loss used in operating activities: | | | | |

| Depreciation and amortization | | 907 | | | 879 | |

| Stock-based compensation | | 4,522 | | | 3,902 | |

| Accretion of debt discount | | 104 | | | — | |

| Acquired in-process research and development, including transaction costs | | — | | | 25,549 | |

| Deferred taxes | | 31 | | | (424) | |

| Change in fair value of Investment in Aytu | | — | | | (5,208) | |

| Change in fair value of warrant liability and unit purchase option liability | | — | | | (14) | |

| Change in value of Guarantee | | — | | | (1,755) | |

| Changes in assets and liabilities: | | | | |

| Accounts receivable, net | | (1,943) | | | (532) | |

| Other receivables | | 1,210 | | | (1,852) | |

| Inventory, net | | (17) | | | 9 | |

| Prepaid expenses and other assets | | 910 | | | (24) | |

| Accounts payable (excluding unpaid debt issuance costs) | | (324) | | | 83 | |

| Income taxes payable | | — | | | 288 | |

| Accrued expenses and other liabilities | | 4,916 | | | (815) | |

| Lease liability, net | | (34) | | | 18 | |

| Net cash used in operating activities | | (37,503) | | | (14,294) | |

| Investing activities | | | | |

| Proceeds from sale of Investment in Aytu, net | | — | | | 12,837 | |

| Net cash paid in merger with Aevi | | — | | | (1,251) | |

| Purchase of property and equipment | | (21) | | | — | |

| Net cash used in investing activities | | (21) | | | 11,586 | |

| Financing activities | | | | |

| Proceeds from issuance of common stock and pre-funded warrants in underwritten public offering, net | | 37,653 | | | — | |

| Proceeds from Notes and warrants, net of debt issuance costs paid | | 19,615 | | | — | |

| Proceeds from underwritten public offering, net | | — | | | 35,428 | |

| Proceeds from registered direct offering, net | | — | | | 5,136 | |

| Proceeds from sale of shares pursuant to common stock private placement, net | | — | | | 3,888 | |

| Proceeds from exercise of stock options | | 1,568 | | | 92 | |

| Proceeds from issuance of common stock under employee stock purchase plan | | 207 | | | 133 | |

| Restricted stock units withheld for taxes | | — | | | (94) | |

| Net cash provided by financing activities | | 59,043 | | | 44,583 | |

| Increase in cash, cash equivalents and restricted cash | | 21,519 | | | 41,875 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 19,106 | | | 3,729 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 40,625 | | | $ | 45,604 | |

| Supplemental disclosures of cash flow information | | | | |

| Cash paid for taxes | | $ | — | | | $ | 316 | |

| Supplemental disclosures of non-cash activities | | | | |

| Unpaid debt issuance costs | | $ | 1,715 | | | $ | — | |

| Issuance of common stock in Aevi Merger | | $ | — | | | $ | 15,496 | |

| Leased asset obtained in exchange for new operating lease liability | | $ | — | | | $ | 376 | |

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows (in thousands):

| | | | | | | | | | | | | | |

| | June 30, |

| | 2021 | | 2020 |

| | | | |

| Cash and cash equivalents | | $ | 40,435 | | | $ | 45,391 | |

| Restricted cash, current | | 41 | | | 33 | |

| Restricted cash, non-current | | 149 | | | 180 | |

| Total cash, cash equivalents and restricted cash | | $ | 40,625 | | | 45,604 | |

See accompanying notes to the unaudited condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Business

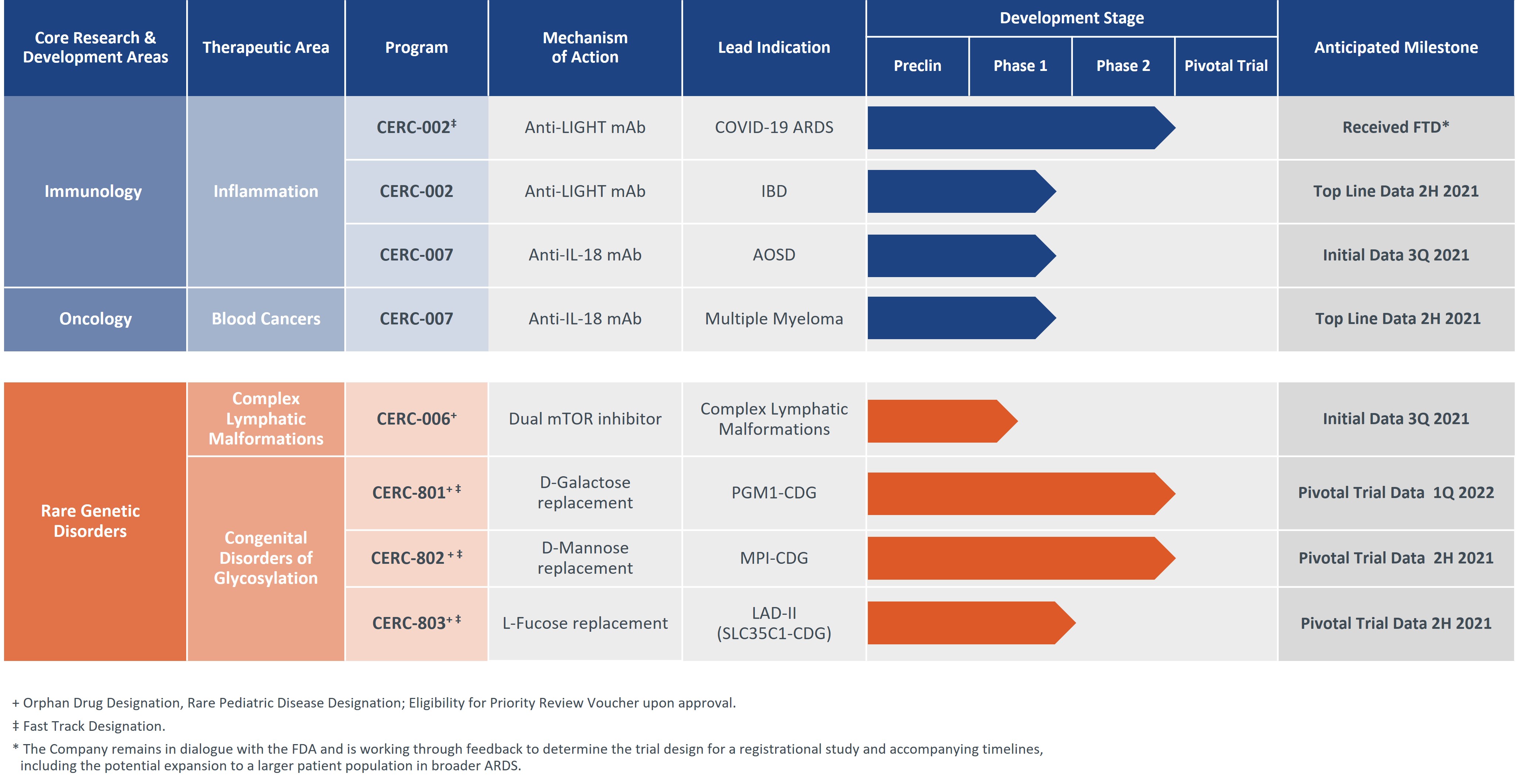

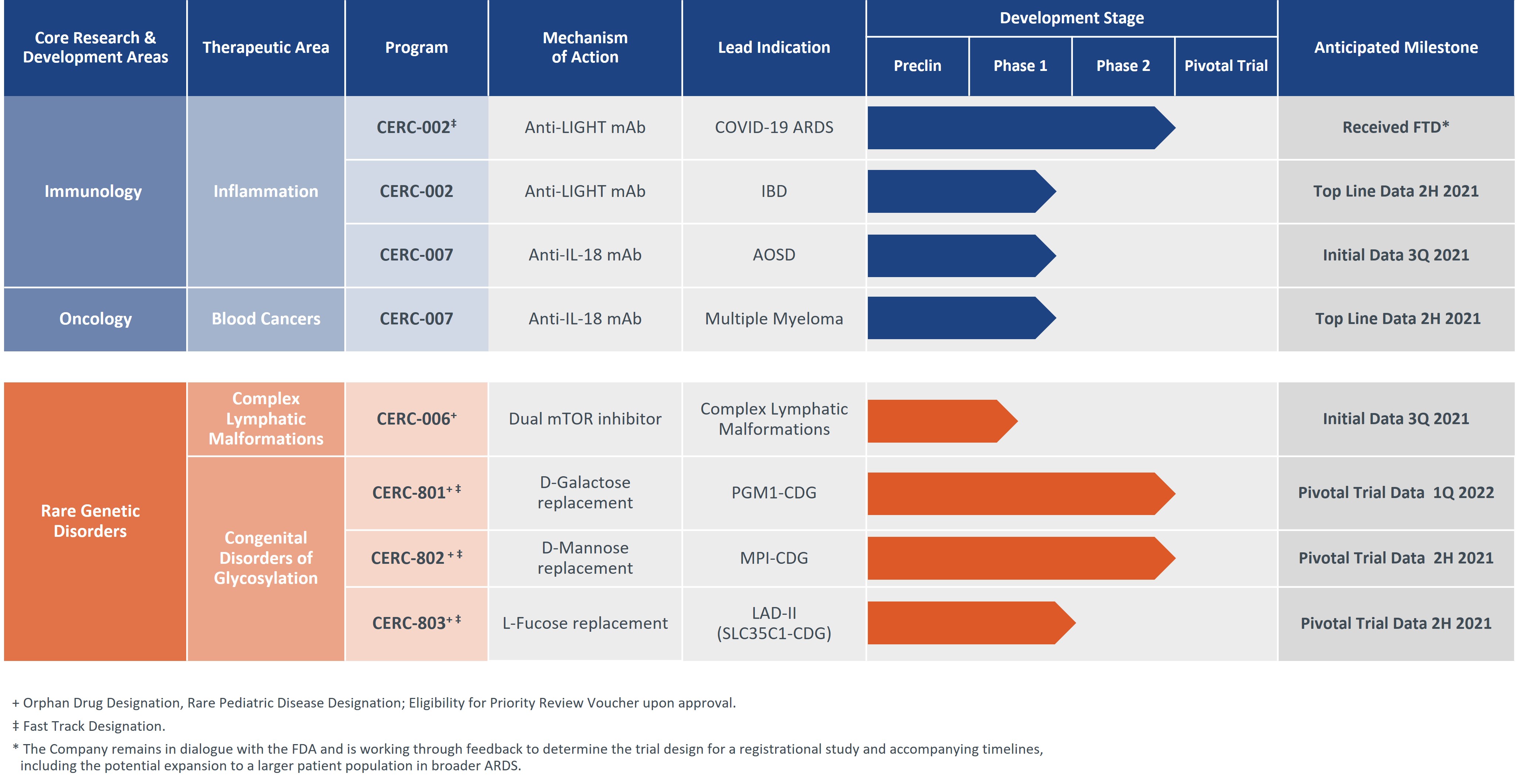

Cerecor Inc. (the “Company” or “Cerecor”) is a biopharmaceutical company focused on becoming a leader in the development and commercialization of treatments for immunologic, immuno-oncologic and rare genetic disorders. The Company is advancing its clinical-stage pipeline of innovative therapies that address unmet patient needs within rare and orphan diseases.

The Company’s rare disease pipeline includes CERC-801, CERC-802 and CERC-803 (“CERC-800 compounds”), which are in development for congenital disorders of glycosylation and CERC-006, an oral mTORc1/c2 inhibitor in development for the treatment of complex lymphatic malformations. The Company is also developing two monoclonal antibodies, CERC-002 and CERC-007. CERC-002, targets the cytokine LIGHT (TNFSF14) and is in clinical development for treatment of inflammatory bowel disease and COVID-19 acute respiratory distress syndrome. CERC-007 targets the cytokine IL-18 and is in clinical development for the treatment of Still’s disease (adult onset Still’s disease and systemic juvenile idiopathic arthritis) and multiple myeloma. CERC-006, 801, 802 and 803 have all received Orphan Drug Designation and Rare Pediatric Disease Designation, which makes all four eligible for a priority review voucher (“PRV”) upon approval from the U.S. Food and Drug Administration (“FDA”).

The Company has one commercialized product, Millipred®, a non-core asset, which is an oral prednisolone indicated across a wide variety of inflammatory conditions.

Cerecor was incorporated and commenced operation in 2011 and completed its initial public offering in October 2015.

Liquidity

As of June 30, 2021, Cerecor had $40.4 million in cash and cash equivalents. In June 2021, the Company entered into a $35.0 million venture debt financing agreement (the “Loan Agreement”) with Horizon Technology Finance Corporation (“Horizon”) and Powerscourt Investments XXV, LP (“Powerscourt, together with Horizon, the “Lenders”). In accordance with the Loan Agreement, $20.0 million of the $35.0 million loan was funded on the closing date (the “Initial Note”), with the remaining $15.0 million fundable upon the Company achieving certain predetermined milestones. The Company received net proceeds of $19.6 million in the second quarter of 2021 and will pay approximately $1.7 million of debt issuance costs in the third quarter of 2021, for total expected net proceeds of $17.9 million (related to the Initial Note funded in the second quarter). The Loan Agreement contains certain covenants and certain other specified events that could result in an event of default, which if not cured or waived, could results in the acceleration of all or a substantial portion of the notes. As of June 30, 2021, the Company did not breach any covenants or specified event that could result in an event of default.

In the third quarter of 2021, the Company received $10.0 million in gross proceeds (the “Second Note”) under the Loan Agreement. The Second Note was made available in connection with the Company’s successful positive initial results from a Phase1b proof-of-concept study evaluating CERC-002 in adult patients with moderate-to-severe Crohn’s disease.

In January 2021, the Company closed an underwritten public offering of 13,971,889 shares of its common stock and 1,676,923 pre-funded warrants for net proceeds of approximately $37.7 million.

In order to meet its cash flow needs, the Company applies a disciplined decision-making methodology as it evaluates the optimal allocation of the Company’s resources between investing in the Company’s existing pipeline assets and acquisitions or in-licensing of new assets. For the six months ended June 30, 2021, Cerecor generated a net loss of $47.8 million and negative cash flows from operations of $37.5 million. As of June 30, 2021, Cerecor had an accumulated deficit of $225.6 million.

The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern; however, losses are expected to continue as the Company continues to invest in its research and development pipeline assets. The Company will require additional financing to fund its operations and to continue to execute its business strategy at least one year after the date the condensed consolidated financial statements included herein were issued. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

To mitigate these conditions and to meet the Company’s capital requirements, management plans to use its current cash on hand along with some combination of the following: (i) dilutive and/or non-dilutive financings, (ii) federal and/or private grants, (iii) other out-licensing or strategic alliances/collaborations of its current pipeline assets, and (iv) out-licensing or sale of its non-core assets. If the Company raises additional funds through collaborations, strategic alliances or licensing arrangements with third parties, the Company might have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates. Subject

to limited exceptions, our venture debt financing agreement prohibits us from incurring certain additional indebtedness, making certain asset dispositions, and entering into certain mergers, acquisitions or other business combination transactions without prior consent of the Lender. If the Company requires but is unable to obtain additional funding, the Company may be forced to make reductions in spending, delay, suspend, reduce or eliminate some or all of its planned research and development programs, or liquidate assets where possible. Due to the uncertainty regarding future financing and other potential options to raise additional funds, management has concluded that substantial doubt exists with respect to the Company’s ability to continue as a going concern within one year after the date that the financial statements in this Quarterly Report were issued.

Over the long term, the Company’s ultimate ability to achieve and maintain profitability will depend on, among other things, the development, regulatory approval, and commercialization of its pipeline assets, and the potential receipt and sale of any PRVs it receives.

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and cash flows. The condensed consolidated balance sheet at December 31, 2020 has been derived from audited financial statements at that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and Exchange Commission (“SEC”).

The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the December 31, 2020 audited consolidated financial statements.

Unless otherwise indicated, all amounts in the following tables are in thousands except share and per share amounts.

Significant Accounting Policies

During the six months ended June 30, 2021, there were no significant changes to the Company’s summary of significant accounting policies contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2020, as filed with the SEC on March 8, 2021.

3. Revenue

The Company generates substantially all of its revenue from sales of Millipred®, an oral prednisolone indicated across a wide variety of inflammatory conditions, which is considered a prescription drug. The Company sells its prescription drug in the United States primarily through wholesale distributors and specialty contracted pharmacies. Wholesale distributors account for substantially all of the Company’s net product revenues and trade receivables. The Company also earns revenue from sales of its prescription drug directly to retail pharmacies. For the three months ended June 30, 2021, the Company’s three largest customers accounted for approximately 62%, 17%, and 20% of the Company’s total net product revenues. For the six months ended June 30, 2021, the Company’s three largest customers accounted for approximately 64%, 16%, and 19% of the Company’s total net product revenues.

The Company has a license and supply agreement for the Millipred® product with a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd. (“Teva”), which expires on September 30, 2023. Beginning July 1, 2021, Cerecor is required to pay Teva fifty percent of the net profit of the Millipred® product following each calendar quarter, subject to a $0.5 million quarterly minimum payment.

Revenue from sales of prescription drugs was $2.7 million and $1.3 million for the three months ended June 30, 2021 and 2020, respectively, and $3.2 million and $4.1 million for the six months ended June 30, 2021 and 2020, respectively. During the first quarter of 2021, the Company’s inventory on hand became short-dated (which the Company considers inventory within six months of

expiration) due to manufacturing delays and therefore the Company recorded a full sales return allowance on sales of short-dated inventory given the high likelihood of return. The Company received the delayed inventory lot in April 2021 and began selling this lot immediately.

License revenue was $0.6 million for the three and six months ended June 30, 2021 related to the out-license of two non-core pipeline assets. In May 2021, the Company out-licensed all of its rights in respect of its non-core neurology pipeline asset, CERC-301, to Alto Neuroscience, Inc. (“Alto”). The Company received a mid-six digit upfront license payment and can earn development, regulatory and sales-based milestone payments as well as modest royalties based on Alto’s activities under the out-license. In June 2021, the Company assigned all of its rights under its license covering its non-core neurology pipeline asset, CERC-406, to ES Therapeutics, LLC (“ES”). ES is a wholly-owned subsidiary of Armistice Capital Master Fund Ltd. (an affiliate of Armistice Capital, LLC and collectively “Armistice”), which is a significant stockholder of the Company and whose chief investment officer, Steven Boyd, serves on the Company’s Board of Directors. The transaction with ES was approved in accordance with the Company’s related party transaction policy. The Company received a low-six digit upfront license payment and can earn development, regulatory, and sales-based milestone payments based on ES’s activities under the assigned license.

4. Aytu Divestiture

Overview of Sale of Pediatric Portfolio and Related Commercial Infrastructure to Aytu BioScience

On November 1, 2019, the Company closed on an asset purchase agreement to sell the Company’s rights, title and interest in assets relating to certain commercialized products (the “Pediatric Portfolio”) and the corresponding commercial infrastructure to Aytu BioScience, Inc. (“Aytu”). Aytu paid consideration of $4.5 million in cash and approximately 9.8 million shares of Aytu convertible preferred stock, and assumed certain of the Company’s liabilities, including the Company’s payment obligations to Deerfield CSF, LLC (“Deerfield”) and certain other liabilities primarily related to contingent consideration and sales returns. Steve Boyd, Chief Investment Officer of Armistice Capital, LLC, a significant stockholder of the Company, serves on each company’s board of directors.

Cerecor retained all rights to Millipred®, an oral prednisolone indicated across a wide variety of inflammatory conditions. Millipred is a non-core asset. Pursuant to a transition services agreement entered into between Aytu and Cerecor, Aytu managed Millipred® commercial operations for 18 months (post November 1, 2019). In May 2021, the Company entered into an amended transition services agreement pursuant to which Aytu continued to manage Millipred®’s commercial operations until June 30, 2021. The Company is currently finalizing its trade and distribution channel to allow it to control third party distribution in the third quarter of 2021. As of the filing date of this Quarterly Report on 10-Q, Aytu continues to distribute Millipred®.

Upon the sale of the Pediatric Portfolio to Aytu, the Pediatric Portfolio met all conditions to be classified as discontinued operations. Therefore, the accompanying condensed consolidated financial statements for the three and six months ended June 30, 2021 and 2020 and as of December 31, 2020 reflect the operations, net of taxes, and related assets and liabilities of the Pediatric Portfolio as discontinued operations. Refer to the “Discontinued Operations” section below for more information, including Cerecor’s continuing involvement.

Deerfield Guarantee

As of the closing date of the Aytu Divestiture on November 1, 2019, Aytu assumed the Company’s debt obligation to Deerfield and the contingent consideration liability related to future royalties on Avadel Pharmaceuticals PLC’s (“Avadel”) pediatric products. In conjunction with the closing of this transaction, the Company entered into a guarantee in favor of Deerfield, which guarantees the payment of the assumed liabilities to Deerfield, which included the debt obligation and includes the contingent consideration related to future royalties on Avadel’s pediatric products (collectively referred to as the “Guarantee”).

Aytu publicly reported that it had paid the $15.0 million balloon payment to Deerfield before it came due in June 2020 and the fixed monthly payments to Deerfield ended in January 2021, thus satisfying the debt obligation. As of November 1, 2019, Aytu was responsible for the remaining contingent consideration related to future royalties on Avadel’s pediatric products of $9.3 million. Aytu is required to pay an amount equal to at least $0.1 million per month. Cerecor’s Guarantee will end upon the earlier of (i) February 5, 2026, or (ii) upon $12.5 million in aggregate deferred payments has been paid to Deerfield. Cerecor is required to make a payment under the Guarantee upon demand by Deerfield if all or any part of the fixed payments and/or deferred payments are not paid by Aytu when due or upon breach of a covenant. The remaining minimum commitments payable as most recently publicly reported by Aytu was $7.3 million as of June 30, 2020, which represents Cerecor’s estimated maximum potential future payments under the Guarantee.

The fair value of the Guarantee, which relates to the Company’s obligation to make future payments if Aytu defaults, was determined at the time of the Aytu Divestiture as the difference between (i) the estimated fair value of the assumed payments using Cerecor’s

estimated cost of debt and (ii) the estimated fair value of the assumed payments using Aytu’s estimated cost of debt. At each subsequent reporting period, the value of the Guarantee is determined based on the expected credit loss of the Guarantee with changes recorded in (loss) income from discontinued operations, net of tax within the consolidated statements of operations and comprehensive loss. The Company concluded that the expected credit loss of the Guarantee was de minimis as of June 30, 2021 based on considerations such as recent financings, cash position, operating cash flows and trends and Aytu’s ability to meet its financial commitments.

Discontinued Operations

The following tables summarizes the liabilities of the discontinued operations as of June 30, 2021 and December 31, 2020 (in thousands):

| | | | | | | | | | | | | | |

| | | June 30, | | December 31, |

| | | 2021 | | 2020 |

| Liabilities | | | | |

| Current liabilities: | | | | |

| Accrued expenses and other current liabilities | | $ | 98 | | | $ | 1,342 | |

| Total current liabilities of discontinued operations | | $ | 98 | | | $ | 1,342 | |

Aytu assumed sales returns of the Pediatric Portfolio made after November 1, 2019 related to sales prior to November 1, 2019 only to the extent such post-Closing sales returns exceed $2.0 million and are less than $2.8 million (in other words, Aytu will only assume $0.8 million of such returns). Therefore, Cerecor is liable for future sales returns of the Pediatric Portfolio sold prior to November 1, 2019 in excess of the $0.8 million assumed by Aytu. The Company estimated future returns as of June 30, 2021 on sales of the Pediatric Portfolio made prior to the transaction close date, which was recognized within accrued expenses and other current liabilities from discontinued operations (and shown in the table above).

Changes in the Company’s estimate of sales returns related to the Pediatric Portfolio is included within discontinued operations on the statement of operations and comprehensive loss and is shown within product revenue, net in the table summarizing the results of discontinued operations below. In future periods, as additional information becomes available, the Company expects to recognize expense (or a benefit) related to actual sales returns of the Pediatric Portfolio in excess (or less than) the returns reserve recorded, which will be recognized within discontinued operations. The Company expects this involvement to continue until sales returns are no longer accepted on sales of the Pediatric Portfolio made prior to November 1, 2019. Returns of these products may be accepted through the second quarter of 2022 (in line with the products’ return policies).

The following table summarizes the results of discontinued operations for the three and six months ended June 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, |

| | | 2021 | | 2020 | | 2021 | | 2020 |

| Product revenue, net | | $ | 69 | | | $ | (455) | | | $ | 63 | | | $ | (1,173) | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Sales and marketing | | — | | | — | | | 101 | | | — | |

| Total operating expenses | | — | | | — | | | 101 | | | — | |

| | | | | | | | |

| Other income: | | | | | | | | |

| Change in value of Guarantee | | — | | | — | | | — | | | 1,755 | |

| Total other income | | — | | | — | | | — | | | 1,755 | |

| Income (loss) from discontinued operations, net of tax | | $ | 69 | | | $ | (455) | | | $ | (38) | | | $ | 582 | |

There were no non-cash operating items from discontinued operations for the six months ended June 30, 2021 and no non-cash investing items from the discontinued operations for the six months ended June 31, 2021 and 2020. The significant non-cash operating item from the discontinued operations for the six months ended June 30, 2020 is contained below (in thousands).

| | | | | | | | | | | | | | |

| | | Six Months Ended June 30, |

| | | 2021 | | 2020 |

| Change in value of Guarantee | | — | | | $ | (1,755) | |

5. Net Loss Per Share

The Company computes earnings per share (“EPS”) using the two-class method. The two-class method of computing EPS is an earnings allocation formula that determines EPS for common stock and any participating securities according to dividends declared and participation rights in undistributed earnings.

The Company had two classes of stock outstanding during the three and six months ended June 30, 2021; common stock and preferred stock. The preferred stock outstanding during the period had the same rights and preferences as the Company’s common stock, other than being non-voting, and is convertible into share of common stock on a 1-for-5 ratio. In April 2021, Armistice, which is a significant stockholder of the Company and whose chief investment officer, Steven Boyd, serves on the Board of the Company, converted the remaining 1,257,143 shares of convertible preferred stock into 6,285,715 shares of Cerecor’s common stock. Refer to Note 11 for more information. Under the two-class method, the convertible preferred stock was considered a separate class of stock until the time it was converted to common shares for EPS purposes and therefore basic and diluted EPS is provided below for both common stock and preferred stock for the periods presented.

EPS for common stock and EPS for preferred stock is computed by dividing the sum of distributed earnings and undistributed earnings for each class of stock by the weighted average number of shares outstanding for each class of stock for the period. In applying the two-class method, undistributed earnings are allocated to common stock and preferred stock based on the weighted average shares outstanding during the period, which assumes the convertible preferred stock has been converted to common stock. The weighted average number of common shares outstanding as of June 30, 2021 includes the weighted average effect of the pre-funded warrants issued in connection with the January 2021 underwritten public offering, the exercise of which requires nominal consideration for the delivery of the shares of common stock (refer to Note 11 for more information).

Diluted net (loss) income per share includes the potential dilutive effect of common stock equivalents as if such securities were converted or exercised during the period, when the effect is dilutive. Common stock equivalents include: (i) outstanding stock options and restricted stock units, which are included under the “treasury stock method” when dilutive; and (ii) common stock to be issued upon the exercise of outstanding warrants, which are included under the “treasury stock method” when dilutive. Because the impact of these items is generally anti-dilutive during periods of net loss, there is no difference between basic and diluted loss per common share for periods with net losses. In periods of net loss, losses are allocated to the participating security only if the security has not only the right to participate in earnings, but also a contractual obligation to share in the Company’s losses.

The following tables set forth the computation of basic and diluted net (loss) income per share of common stock and preferred stock for the three and six months ended June 30, 2021 and 2020 (in thousands, except share and per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | June 30, 2021 |

| | Common stock | | Preferred stock |

| | Continuing Operations | | Discontinued Operations | | Continuing Operations | | Discontinued Operations |

| Numerator: | | | | | | | | |

| Allocation of undistributed net loss | | $ | (16,991) | | | $ | 68 | | | $ | (183) | | | $ | 1 | |

| Denominator: | | | | | | | | |

| Weighted average shares | | 96,179,581 | | | 96,179,581 | | | 207,221 | | | 207,221 | |

| Basic and diluted net loss per share | | $ | (0.18) | | | $ | — | | | $ | (0.88) | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended |

| | | June 30, 2021 |

| | Common stock | | Preferred stock |

| | Continuing Operations | | Discontinued Operations | | Continuing Operations | | Discontinued Operations |

| Numerator: | | | | | | | | |

| Allocation of undistributed net loss | | $ | (45,934) | | | $ | (37) | | | $ | (1,813) | | | $ | (1) | |

| Denominator: | | | | | | | | |

| Weighted average shares | | 92,399,073 | | | 92,399,073 | | | 729,282 | | | 729,282 | |

| Basic and diluted net loss per share | | $ | (0.50) | | | $ | — | | | $ | (2.49) | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | June 30, 2020 |

| | Common stock | | Preferred stock |

| | Continuing Operations | | Discontinued Operations | | Continuing Operations | | Discontinued Operations |

| Numerator: | | | | | | | | |

| Allocation of undistributed net loss | | $ | (11,659) | | | $ | (414) | | | $ | (1,167) | | | $ | (41) | |

| Denominator: | | | | | | | | |

| Weighted average shares | | 62,806,926 | | | 62,806,926 | | | 1,257,143 | | | 1,257,143 | |

| Basic and diluted net loss per share | | $ | (0.18) | | | $ | (0.01) | | | $ | (0.93) | | | $ | (0.03) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six Months Ended |

| | | June 30, 2020 |

| | Common stock | | Preferred stock |

| | Continuing Operations | | Discontinued Operations | | Continuing Operations | | Discontinued Operations |

| Numerator: | | | | | | | | |

| Allocation of undistributed net loss | | $ | (31,099) | | | $ | 517 | | | $ | (3,881) | | | $ | 65 | |

| Denominator: | | | | | | | | |

| Weighted average shares | | 58,370,843 | | | 58,370,843 | | | 1,457,143 | | | 1,457,143 | |

| Basic and diluted net loss per share | | $ | (0.53) | | | $ | 0.01 | | | $ | (2.66) | | | $ | 0.04 | |

The following outstanding securities have been excluded from the computation of diluted weighted shares outstanding for the three and six months ended June 30, 2021 and 2020, as they could have been anti-dilutive:

| | | | | | | | | | | | | | |

| | | Three and Six Months Ended |

| | June 30, |

| | | 2021 | | 2020 |

| Stock options | | 12,645,410 | | 9,363,265 |

Warrants on common stock1 | | 4,406,224 | | 4,024,708 |

| Restricted Stock Units | | 77,916 | | 155,833 |

| Underwriters’ unit purchase option | | — | | 40,000 |

1 The above table excludes 1,676,923 pre-funded warrants for the three and six months ended June 30, 2021. See “Q1 2021 Financing” in Note 11 for more information.

6. Asset Acquisition

Aevi Merger

In the first quarter of 2020, the Company consummated its merger with Aevi Genomic Medicine Inc. (“Aevi”), in which Cerecor acquired the rights to CERC-002, CERC-006 and CERC-007 (the “Merger” or the “Aevi Merger”).

The Merger consideration included (i) stock valued at approximately $15.5 million, resulting in the issuance of approximately 3.9 million shares of Cerecor common stock to Aevi stockholders, (ii) forgiveness of $4.1 million the Company had loaned Aevi prior to the Merger closing, (iii) contingent value rights for up to an additional $6.5 million in subsequent payments based on certain development milestones (discussed further in Note 14), and (iv) transaction costs of $1.5 million.

The Company recorded this transaction as an asset purchase as opposed to a business combination because management concluded that substantially all the value received was related to one group of similar identifiable assets, which was the in-process research and development (“IPR&D”) for two early phase therapies. The Company considered these pipeline assets similar due to similarities in the risks of development, stage of development, regulatory pathway, patient populations and economics of commercialization. The fair value of $25.5 million (consisting primarily of $24.0 million IPR&D, $0.3 million of cash and $0.9 million of assembled workforce) was immediately recognized as acquired in-process research and development expense in the Company’s consolidated statement of operations and comprehensive loss because the IPR&D asset has no alternate use due to the stage of development. The assembled workforce asset was recorded to intangible assets and will be amortized over an estimated useful life of two years.

7. Fair Value Measurements

ASC No. 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value as the price that would be received to sell an asset, or paid to transfer a liability, in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. The fair value standard also establishes a three‑level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

•Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

•Level 2—inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model‑derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

•Level 3—inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

The following table presents, for each of the fair value hierarchy levels required under ASC 820, the Company’s assets and liabilities that are measured at fair value on a recurring basis (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2021 |

| | | Fair Value Measurements Using |

| | | Quoted prices in | | Significant other | | Significant |

| | | active markets for | | observable | | unobservable |

| | | identical assets | | inputs | | inputs |

| | | (Level 1) | | (Level 2) | | (Level 3) |

| Assets | | | | | | |

| Investments in money market funds* | | $ | 38,973 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | | |

| | | December 31, 2020 |

| | | Fair Value Measurements Using |

| | | Quoted prices in | | Significant other | | Significant |

| | | active markets for | | observable | | unobservable |

| | | identical assets | | inputs | | inputs |

| | | (Level 1) | | (Level 2) | | (Level 3) |

| Assets | | | | | | |

| Investments in money market funds* | | $ | 17,503 | | | $ | — | | | $ | — | |

*Investments in money market funds are reflected in cash and cash equivalents on the accompanying condensed consolidated balance sheets.

As of June 30, 2021 and December 31, 2020, the Company’s financial instruments included cash and cash equivalents, restricted cash, accounts receivable, other receivables, prepaid and other current assets, accounts payable, and accrued expenses and other current liabilities. The carrying amounts reported in the accompanying condensed consolidated financial statements approximate their respective fair values because of the short-term nature of these accounts.

No changes in valuation techniques or inputs occurred during the six months ended June 30, 2021 and 2020. No transfers of assets between Level 1 and Level 2 of the fair value measurement hierarchy occurred during the six months ended June 30, 2021 and 2020.

8. Leases

The Company currently occupies two leased properties, both of which serve as administrative office space. The Company determined that both leases are operating leases based on the lease classification test performed at lease commencement.

The annual base rent for the Company’s office located in Rockville, Maryland is $161,671, subject to annual 2.5% increases over the term of the lease. The applicable lease provided for a rent abatement for a period of 12 months following the Company’s date of occupancy. The lease has an initial term of 10 years from the date the Company makes its first annual fixed rent payment, which occurred in January 2020. The Company has the option to extend the lease two times, each for a period of five years, and may terminate the lease as of the sixth anniversary of the first annual fixed rent payment, upon the payment of a termination fee. As of the lease commencement date, it was not reasonably certain that the Company will exercise the renewal periods or early terminate the lease and therefore the end date of the lease for accounting purposes is January 31, 2030.

The Company entered into a sublease for additional administrative office space in Chesterbrook, Pennsylvania in May 2020 (the “Chesterbrook Lease”). The annual base rent under the Chesterbrook Lease is $280,185. The lease expires in November 2021.

The weighted average remaining term of the operating leases at June 30, 2021 was 7.9 years.

Supplemental balance sheet information related to the leased property is as follows (in thousands):

| | | | | | | | | | | | | | |

| | | As of |

| | | June 30, 2021 | | December 31, 2020 |

| Property and equipment, net | | $ | 773 | | | $ | 917 | |

| | | | |

| Accrued expenses and other current liabilities | | $ | 288 | | | $ | 426 | |

| Other long-term liabilities | | 998 | | | 1,038 | |

| Total operating lease liabilities | | $ | 1,286 | | | $ | 1,464 | |

The operating lease right-of-use (“ROU”) assets are included in property and equipment and the lease liabilities are included in accrued expenses and other current liabilities and other long-term liabilities in our condensed consolidated balance sheets. The Company utilized a weighted average discount rate of 7.5% to determine the present value of the lease payments.

The components of lease expense for the three and six months ended June 30, 2021 and 2020 were as follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Six Months Ended June 30, | | |

| | 2021 | | 2020 | | 2021 | | 2020 | | | | |

| Operating lease cost* | | $ | 95 | | | $ | 87 | | | $ | 190 | | | $ | 142 | | | | | |

*Includes short-term leases, which are immaterial.

The following table shows a maturity analysis of the operating lease liabilities as of June 30, 2021 (in thousands):

| | | | | | | | |

| | | |

| | | Undiscounted Cash Flows |

| July 1, 2021 through December 31, 2021 | | $ | 202 | |

| 2022 | | 174 | |

| 2023 | | 178 | |

| 2024 | | 183 | |

| 2025 | | 187 | |

| 2026 | | 192 | |

| Thereafter | | 621 | |

| Total lease payments | | $ | 1,737 | |

| Less implied interest | | (451) | |

| Total | | $ | 1,286 | |

9. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities as of June 30, 2021 and December 31, 2020 consisted of the following (in thousands):

| | | | | | | | | | | | | | |

| | | As of |

| | | June 30, 2021 | | December 31, 2020 |

| Research and development | | $ | 9,838 | | | $ | 4,939 | |

| Compensation and benefits | | 2,566 | | | 3,119 | |

| General and administrative | | 2,217 | | | 771 | |

| Sales and marketing | | 246 | | | 31 | |

| Commercial operations | | 2,451 | | | 1,913 | |

| Lease liability, current | | 288 | | | 426 | |

| Other | | 5 | | | 111 | |

| Total accrued expenses and other current liabilities | | $ | 17,611 | | | $ | 11,310 | |

10. Notes Payable

Overview

On June 4, 2021, the Company entered into a $35.0 million Loan Agreement with Horizon and Powerscourt. On the closing date, the Company received $20.0 million, with the remaining $15.0 million fundable upon the Company achieving certain predetermined milestones, one of which was achieved in July 2021 (refer to more information below).

Each advance under the Loan Agreement will mature 42 months from the first day of the month following the funding of the advance. Each advance accrues interest at a per annum rate of interest equal to 6.25% plus the prime rate, as reported in the Wall Street Journal (subject to a floor of 3.25%). The Loan Agreement provided for interest-only payments for each advance for the first 18 months. The interest-only period may be extended to 24 months if the Company satisfies the Interest Only Extension Milestone (as defined in the Loan Agreement), which the Company met in the third quarter of 2021. Thereafter, amortization payments will be payable in monthly installments of principal and interest through each advance’s maturity date. Upon ten business days’ prior written notice, the Company may prepay all of the outstanding advances by paying the entire principal balance and all accrued and unpaid interest, subject to prepayment charges of up to 3% of the then outstanding principal balance. Upon the earlier of (i) payment in full of the principal balance, (ii) an event of default, or (iii) the maturity date, the Company will pay an additional final payment of 3% of the principal loan amount to the Lenders.

Each advance of the loan is secured by a lien on substantially all of the assets of the Company, other than Intellectual Property and Excluded Collateral (in each case as defined in the Loan Agreement), and contains customary covenants and representations, including a financial reporting covenant and limitations on dividends, indebtedness, collateral, investments, distributions, transfers, mergers or acquisitions taxes, corporate changes, deposit accounts, and subsidiaries.

The events of default under the Loan Agreement include but are not limited to, failing to make a payment, breach of covenant, or occurrence of a material adverse change. If an event of default occurs, the Lenders are entitled to accelerate the loan amounts due, or

take other enforcement actions. As of June 30, 2021, the Company did not breach any covenants or specified event that could result in an event of default.

Initial Note

The Initial Note of $20.0 million will mature on January 1, 2025 (the “Initial Note Maturity Date”). As of June 30, 2021, the Company was required to make interest-only payments of the Initial Note through January 1, 2023 with monthly amortization payments of principal and interest thereafter through the Initial Note Maturity Date. Subsequent to the second quarter of 2021, the Company satisfied the Interest Only Extension Milestone; refer to further information below.

On June 4, 2021, pursuant to the Loan Agreement, the Company issued warrants to the Lenders to purchase 403,844 shares of the Company’s common stock with an exercise price of $2.60 (the “Warrants”). The Warrants are exercisable for ten years from the date of issuance. The Lenders may exercise the Warrants either by (a) cash or check or (b) through a net issuance conversion. The Warrants, which met equity classification, were recognized as a component of permanent stockholders’ equity within additional paid-in-capital and were recorded at the issuance date using a relative fair value allocation method. The Company valued the Warrants at issuance, which resulted in a discount on the debt, and allocated the proceeds from the loan proportionately to the notes payable and to the Warrants, of which $0.9 million was allocated to the Warrants.