10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on November 9, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

for the quarterly period ended | |||||

| OR | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

COMMISSION FILE NUMBER: 001-37590

(Exact name of registrant as specified in its charter)

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

||||

|

(Address of principal executive offices)

|

(

(Registrant’s telephone number,

including area code)

|

||||

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

|

|

Nasdaq Capital Market | |||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

Large accelerated filer ☐

|

Accelerated filer ☐ | |||||||

Smaller reporting company |

||||||||

Emerging growth company |

||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☑

As of November 5, 2021, the registrant had 112,317,829 shares of common stock outstanding.

AVALO THERAPEUTICS, INC.

FORM 10-Q

For the Quarter Ended September 30, 2021

TABLE OF CONTENTS

| Page | |||||||||||||||||

| a) | |||||||||||||||||

| b) | |||||||||||||||||

| d) | |||||||||||||||||

| c) | |||||||||||||||||

| e) | |||||||||||||||||

2

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share and per share data)

| September 30, 2021 | December 31, 2020 | |||||||||||||

| (unaudited) | ||||||||||||||

| Assets | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Accounts receivable, net | ||||||||||||||

| Other receivables | ||||||||||||||

| Inventory, net | ||||||||||||||

| Prepaid expenses and other current assets | ||||||||||||||

| Restricted cash, current portion | ||||||||||||||

| Total current assets | ||||||||||||||

| Property and equipment, net | ||||||||||||||

| Other long-term asset | ||||||||||||||

| Intangible assets, net | ||||||||||||||

| Goodwill | ||||||||||||||

| Restricted cash, net of current portion | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| Liabilities and stockholders’ equity | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accounts payable | $ | $ | ||||||||||||

| Accrued expenses and other current liabilities | ||||||||||||||

| Current liabilities of discontinued operations | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Notes payable | ||||||||||||||

| Royalty obligation | ||||||||||||||

| Deferred tax liability, net | ||||||||||||||

| Other long-term liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Stockholders’ equity: | ||||||||||||||

Common stock—$ |

||||||||||||||

Preferred stock—$ |

||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Accumulated deficit | ( |

( |

||||||||||||

| Total stockholders’ equity | ||||||||||||||

| Total liabilities and stockholders’ equity | $ | $ | ||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

3

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In thousands, except per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||||||||

| September 30, | September 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||

| Product revenue, net | $ | $ | $ | $ | ||||||||||||||||||||||

| License revenue | ||||||||||||||||||||||||||

| Total revenues, net | ||||||||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Cost of product sales | ||||||||||||||||||||||||||

| Research and development | ||||||||||||||||||||||||||

| Acquired in-process research and development | ||||||||||||||||||||||||||

| General and administrative | ||||||||||||||||||||||||||

| Sales and marketing | ||||||||||||||||||||||||||

| Amortization expense | ||||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| ( |

( |

( |

( |

|||||||||||||||||||||||

| Other (expense) income: | ||||||||||||||||||||||||||

| Change in fair value of Investment in Aytu | ||||||||||||||||||||||||||

| Other (expense) income, net | ( |

( |

||||||||||||||||||||||||

| Interest (expense) income, net | ( |

( |

||||||||||||||||||||||||

| Total other (expense) income, net from continuing operations | ( |

( |

||||||||||||||||||||||||

| Loss from continuing operations before taxes | ( |

( |

( |

( |

||||||||||||||||||||||

| Income tax expense (benefit) | ( |

( |

||||||||||||||||||||||||

| Loss from continuing operations | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | ( |

|||||||||||||||||||||||||

| Net loss | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Net (loss) income per share of common stock, basic and diluted: | ||||||||||||||||||||||||||

| Continuing operations | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Discontinued operations | ( |

|||||||||||||||||||||||||

| Net loss per share of common stock, basic and diluted | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Net (loss) income per share of preferred stock, basic and diluted: | ||||||||||||||||||||||||||

| Continuing operations | $ | ( |

$ | ( |

$ | ( |

||||||||||||||||||||

| Discontinued operations | ( |

|||||||||||||||||||||||||

| Net loss per share of preferred stock, basic and diluted | $ | ( |

$ | ( |

$ | ( |

||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

4

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Changes in Stockholders’ Equity (Unaudited)

(In thousands, except share amounts)

| Common stock | Preferred Stock | Additional paid-in | Accumulated | Total stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | deficit | equity | |||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2021 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Issuance of common stock in underwritten public offering, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to ATM Program, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | $ | ( |

( |

|||||||||||||||||||||||||||||||||

| Balance, September 30, 2021 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Common stock | Preferred Stock | Additional paid-in | Accumulated | Total stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | deficit | equity | |||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2021 | |||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Issuance of shares of common stock and pre-funded warrants in underwritten public offering, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock in underwritten public offering, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of common stock pursuant to ATM Program, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of equity classified warrants related to venture debt financing agreement | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Exercise of stock options | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Conversion of preferred stock to common stock | ( |

( |

( |

— | |||||||||||||||||||||||||||||||||||||

| Shares purchased through employee stock purchase plan | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Restricted stock units vested during period | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||

| Balance, September 30, 2021 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

5

| Common stock | Preferred Stock | Additional paid-in | Accumulated | Total stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | deficit | equity | |||||||||||||||||||||||||||||||||||

| Three Months Ended September 30, 2020 | |||||||||||||||||||||||||||||||||||||||||

| Balance, June 30, 2020 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||

| Balance, September 30, 2020 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Common stock | Preferred Stock | Additional paid-in | Accumulated | Total stockholders’ | |||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | capital | deficit | equity | |||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, 2020 | |||||||||||||||||||||||||||||||||||||||||

| Balance, December 31, 2019 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

| Conversion of preferred stock to common stock | ( |

( |

( |

— | |||||||||||||||||||||||||||||||||||||

| Issuance of shares related to Aevi Merger | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of shares pursuant to registered direct offering, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of shares pursuant to common stock private placement, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Issuance of shares of common stock in underwritten public offering, net | — | — | — | ||||||||||||||||||||||||||||||||||||||

| Exercise of stock options and warrants | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Restricted stock units vested during period | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Restricted stock units withheld for taxes | ( |

— | — | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||

| Shares purchased through employee stock purchase plan | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||

| Balance, September 30, 2020 | $ | $ | $ | $ | ( |

$ | |||||||||||||||||||||||||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

6

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

(Amounts in thousands)

| Nine Months Ended September 30, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Operating activities | ||||||||||||||

| Net loss | $ | ( |

$ | ( |

||||||||||

| Adjustments to reconcile net loss used in operating activities: | ||||||||||||||

| Depreciation and amortization | ||||||||||||||

| Stock-based compensation | ||||||||||||||

| Accretion of debt discount | ||||||||||||||

| Acquired in-process research and development, including transaction costs | ||||||||||||||

| Deferred taxes | ||||||||||||||

| Change in fair value of Investment in Aytu | ( |

|||||||||||||

| Change in fair value of warrant liability and unit purchase option liability | ( |

|||||||||||||

| Change in value of Guarantee | ( |

|||||||||||||

| Changes in assets and liabilities: | ||||||||||||||

| Accounts receivable, net | ( |

|||||||||||||

| Other receivables | ( |

( |

||||||||||||

| Other long-term asset | ( |

|||||||||||||

| Inventory, net | ( |

|||||||||||||

| Prepaid expenses and other assets | ( |

|||||||||||||

| Accounts payable | ( |

|||||||||||||

| Income taxes payable | ||||||||||||||

| Accrued expenses and other liabilities | ||||||||||||||

| Lease liability, net | ( |

|||||||||||||

| Net cash used in operating activities | ( |

( |

||||||||||||

| Investing activities | ||||||||||||||

| Proceeds from sale of Investment in Aytu, net | ||||||||||||||

| Net cash paid in merger with Aevi | ( |

|||||||||||||

| Purchase of property and equipment | ( |

( |

||||||||||||

| Net cash used in investing activities | ( |

|||||||||||||

| Financing activities | ||||||||||||||

| Proceeds from issuance of common stock and pre-funded warrants in underwritten public offering, net | ||||||||||||||

| Proceeds from Notes and warrants, net of debt issuance costs paid | ||||||||||||||

| Proceeds from issuance of common stock in underwritten public offering, net | ||||||||||||||

| Proceeds from common stock pursuant to ATM Program, net | ||||||||||||||

| Proceeds from registered direct offering, net | ||||||||||||||

| Proceeds from sale of shares pursuant to common stock private placement, net | ||||||||||||||

| Proceeds from exercise of stock options | ||||||||||||||

| Proceeds from issuance of common stock under employee stock purchase plan | ||||||||||||||

| Restricted stock units withheld for taxes | ( |

|||||||||||||

| Net cash provided by financing activities | ||||||||||||||

| Increase in cash, cash equivalents and restricted cash | ||||||||||||||

| Cash, cash equivalents, and restricted cash at beginning of period | ||||||||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | $ | ||||||||||||

| Supplemental disclosures of cash flow information | ||||||||||||||

| Cash paid for interest | $ | $ | ||||||||||||

| Cash paid for taxes | $ | $ | ||||||||||||

| Supplemental disclosures of non-cash activities | ||||||||||||||

| Issuance of common stock in Aevi Merger | $ | $ | ||||||||||||

| Leased asset obtained in exchange for new operating lease liability | $ | $ | ||||||||||||

7

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows (in thousands):

| September 30, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Restricted cash, current | ||||||||||||||

| Restricted cash, non-current | ||||||||||||||

| Total cash, cash equivalents and restricted cash | $ | |||||||||||||

See accompanying notes to the unaudited condensed consolidated financial statements.

8

AVALO THERAPEUTICS, INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Business

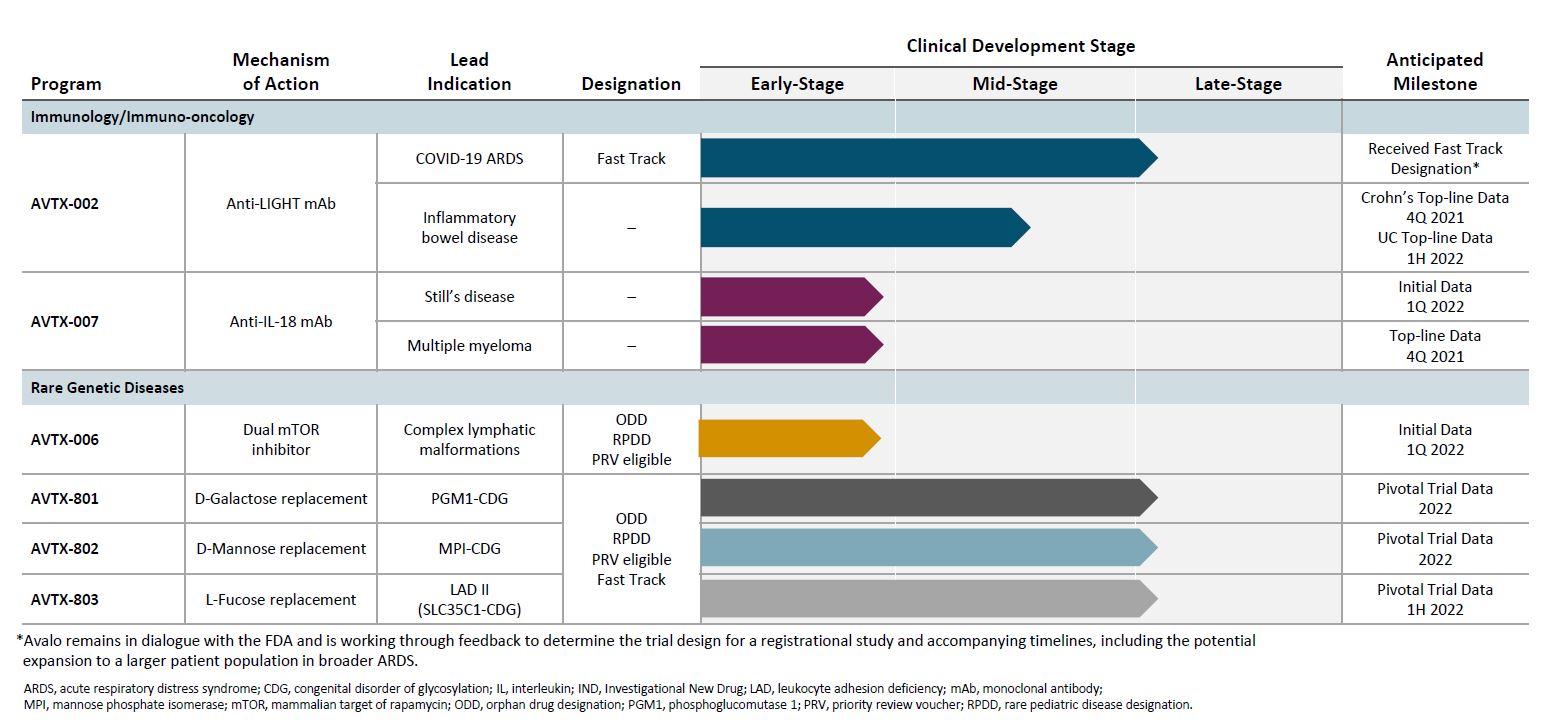

Avalo Therapeutics, Inc. (the “Company” or “Avalo”) is a leading clinical-stage precision medicine company that discovers, develops, and commercializes targeted therapeutics for patients with significant unmet clinical need in immunology, immuno-oncology, and rare genetic diseases. The Company has built a diverse portfolio of innovative therapies to deliver meaningful medical impact for patients in urgent need. Avalo’s clinical candidates commonly have a proven mechanistic rationale, biomarkers and/or an established proof-of-concept to expedite and increase the probability of success.

In August 2021, the Company changed its corporate name change from Cerecor Inc. to Avalo Therapeutics, Inc. by filing a Certificate of Amendment to our Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware and merged certain wholly-owned subsidiaries into the Company to consolidate its corporate structure. The name change underscores the Company’s transition to developing innovative targeted therapies in immunology, immuno-oncology, and rare genetic diseases.

Avalo was incorporated and commenced operation in 2011 and completed its initial public offering in October 2015.

Liquidity

As of September 30, 2021, Avalo had $71.5 million in cash and cash equivalents. In September 2021, the Company closed an underwritten public offering of 14,308,878 shares of common stock for net proceeds of approximately $29.0 million. Additionally, in August 2021, the Company sold 2.0 million shares of common stock under its “at-the-market” sales agreement (the “ATM Program”) for net proceeds of approximately $5.3 million.

In June 2021, the Company entered into a $35.0 million venture debt financing agreement (the “Loan Agreement”) with Horizon Technology Finance Corporation and Powerscourt Investments XXV, LP (collectively, the “Lenders”). As of September 30, 2021, the Company has received the full $35.0 million, $20.0 million of which was funded on the closing date in the second quarter of 2021 and the remaining $15.0 million was funded during the third quarter of 2021 in two separate tranches. The Loan Agreement contains certain covenants and certain other specified events that could result in an event of default, which if not cured or waived, could result in the acceleration of all or a substantial portion of the notes. As of the filing date of this Quarterly Report on Form 10-Q, the Company was not aware of any breach of covenants nor received any notice of event of default from the Lenders.

In the first quarter of 2021, the Company closed an underwritten public offering of 13,971,889 shares of its common stock and 1,676,923 pre-funded warrants for net proceeds of approximately $37.7 million.

In order to meet its cash flow needs, the Company applies a disciplined decision-making methodology as it evaluates the optimal allocation of the Company’s resources between investing in the Company’s existing pipeline assets and acquisitions or in-licensing of new assets. For the nine months ended September 30, 2021, Avalo generated a net loss of $65.2 million and negative cash flows from operations of $53.8 million. As of September 30, 2021, Avalo had an accumulated deficit of $243.0 million.

The accompanying condensed consolidated financial statements have been prepared assuming the Company will continue as a going concern; however, losses are expected to continue as the Company continues to invest in its research and development pipeline assets. The Company will require additional financing to fund its operations and to continue to execute its business strategy at least one year after the date the condensed consolidated financial statements included herein were issued. These conditions raise substantial doubt about the Company’s ability to continue as a going concern.

To mitigate these conditions and to meet the Company’s capital requirements, management plans to use its current cash on hand along with some combination of the following: (i) dilutive and/or non-dilutive financings, (ii) federal and/or private grants, (iii) other out-licensing or strategic alliances/collaborations of its current pipeline assets, and (iv) out-licensing or sale of its non-core assets. If the Company raises additional funds through collaborations, strategic alliances or licensing arrangements with third parties, the Company might have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates. Subject to limited exceptions, our venture debt financing agreement prohibits us from incurring certain additional indebtedness, making certain asset dispositions, and entering into certain mergers, acquisitions or other business combination transactions without prior consent of the Lenders. If the Company requires but is unable to obtain additional funding, the Company may be forced to make reductions in spending, delay, suspend, reduce or eliminate some or all of its planned research and development programs, or liquidate assets where possible. Due to the uncertainty regarding future financing and other potential options to raise additional funds, management has

9

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and cash flows. The condensed consolidated balance sheet at December 31, 2020 has been derived from audited financial statements at that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and Exchange Commission (“SEC”).

The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the December 31, 2020 audited consolidated financial statements.

Unless otherwise indicated, all amounts in the following tables are in thousands except share and per share amounts.

Significant Accounting Policies

3. Revenue

The Company generates substantially all of its revenue from sales of Millipred®, an oral prednisolone indicated across a wide variety of inflammatory conditions, which is considered a prescription drug. The Company sells its prescription drug in the United States primarily through wholesale distributors. Wholesale distributors account for substantially all of the Company’s net product revenues and trade receivables. For the three months ended September 30, 2021, the Company’s three largest customers accounted for approximately 52 %, 24 %, and 24 % of the Company’s total net product revenues. For the nine months ended September 30, 2021, the Company’s three largest customers accounted for approximately 62 %, 20 %, and 17 % of the Company’s total net product revenues. Revenue from sales of prescription drugs was $1.4 million and $1.1 million for the three months ended September 30, 2021 and 2020, respectively, and $4.6 million and $5.2 million for the nine months ended September 30, 2021 and 2020, respectively.

The Company has a license and supply agreement for the Millipred® product with a wholly owned subsidiary of Teva Pharmaceutical Industries Ltd. (“Teva”), which expires on September 30, 2023. Beginning July 1, 2021, Avalo is required to pay Teva fifty percent of the net profit of the Millipred® product following each calendar quarter, subject to a $0.5 million quarterly minimum payment. For the three and nine months ended September 30, 2021, the Company recognized $0.7

License revenue was $0.6 million for the nine months ended September 30, 2021, which was related to upfront fees received in the second quarter of 2021 as a result of the out-licenses of the Company’s rights to its non-core neurology pipeline assets: AVTX-301 to Alto Neuroscience, Inc. (“Alto”) and AVTX-406 to ES Therapeutics, LLC (“ES”). ES is a wholly-owned subsidiary of Armistice Capital Master Fund Ltd. (an affiliate of Armistice Capital, LLC and collectively “Armistice”), which is a significant stockholder of

10

4. Aytu Divestiture

Overview of Sale of Pediatric Portfolio and Related Commercial Infrastructure to Aytu BioScience

On November 1, 2019, the Company closed on an asset purchase agreement to sell the Company’s rights, title and interest in assets relating to certain commercialized products (the “Pediatric Portfolio”) and the corresponding commercial infrastructure to Aytu BioScience, Inc. (“Aytu”). Aytu paid consideration of $4.5 million in cash and approximately 9.8 million shares of Aytu convertible preferred stock, and assumed certain of the Company’s liabilities, including the Company’s payment obligations to Deerfield CSF, LLC (“Deerfield”) and certain other liabilities primarily related to contingent consideration and sales returns. Steve Boyd, chief investment officer of Armistice Capital, LLC, a significant stockholder of the Company and a member of the Company’s Board of Directors, served on Aytu’s Board from March 2019 until August 30, 2021. The transactions and agreements between the Company and Aytu were approved in accordance with the Company’s related party transaction policy.

Upon the sale of the Pediatric Portfolio to Aytu, the Pediatric Portfolio met all conditions to be classified as discontinued operations. Therefore, the accompanying condensed consolidated financial statements for the three and nine months ended September 30, 2021 and 2020 and as of December 31, 2020 reflect the operations, net of taxes, and related assets and liabilities of the Pediatric Portfolio as discontinued operations. Refer to the “Discontinued Operations” section below for more information, including Avalo’s continuing involvement, which the Company expects to end in the second quarter of 2022.

Avalo retained all rights to Millipred®, which the Company considers a non-core asset. Aytu managed Millipred® commercial operations until June 30, 2021 pursuant to transition service agreements entered into between Aytu and Avalo, which included Aytu collecting cash on behalf of Avalo for sales of Millipred® until the second quarter of 2020. In the third quarter of 2021, Avalo finalized its trade and distribution channel to allow it to control third party distribution and began managing Millipred® commercial operations at that time. The Company agreed to postpone receipt of $2.0 million from Aytu in order to better facilitate the transition of commercial operations from Aytu. $1.0 2.0 million as an other long-term asset on the Company’s condensed consolidated balance sheet as of September 30, 2021.

Deerfield Guarantee

As of the closing date of the Aytu Divestiture on November 1, 2019, Aytu assumed the Company’s debt obligation to Deerfield which included monthly payments of $0.1 million through January 2021, with a balloon payment of $15.0 million that was to be due in January 2021. Aytu also assumed the contingent consideration liability related to future royalties on Avadel Pharmaceuticals PLC’s (“Avadel”) pediatric products, which included minimum monthly payments of $0.1 million through February 2026. In conjunction with the closing of this transaction, the Company entered into a guarantee in favor of Deerfield, which guarantees the payment of the assumed liabilities to Deerfield, which included the debt obligation and includes the contingent consideration related to future royalties on Avadel’s pediatric products (collectively referred to as the “Guarantee”).

Aytu publicly reported that it had paid the $15.0 million balloon payment to Deerfield before it came due in June 2020 and the fixed monthly payments to Deerfield ended in January 2021, thus satisfying the debt obligation. Aytu publicly reported that it had entered into a Waiver, Release and Consent in June 2021, pursuant to which it paid $2.8 million to Deerfield in early satisfaction of the remaining contingent consideration related to future royalties on Avadel’s pediatric products. Aytu agreed to pay the remaining fixed obligation of $3.0 million in six equal quarterly payments of $0.5 million over the next six quarters commencing September 1, 2021.

Avalo is required to make a payment under the Guarantee upon demand by Deerfield if all or any part of the fixed payments are not paid by Aytu when due or upon breach of a covenant. The remaining minimum commitments payable (as most recently publicly reported by Aytu) was $3.0 million as of June 30, 2021, which represents Avalo’s estimated maximum potential future payments under the Guarantee.

The fair value of the Guarantee, which relates to the Company’s obligation to make future payments if Aytu defaults, was determined at the time of the Aytu Divestiture as the difference between (i) the estimated fair value of the assumed payments using Avalo’s estimated cost of debt and (ii) the estimated fair value of the assumed payments using Aytu’s estimated cost of debt. At each

11

subsequent reporting period, the value of the Guarantee is determined based on the expected credit loss of the Guarantee with changes recorded in (loss) income from discontinued operations, net of tax within the consolidated statements of operations and comprehensive loss. The Company concluded that the expected credit loss of the Guarantee was de minimis as of September 30, 2021 based on considerations such as recent financings, cash position, operating cash flows and trends and Aytu’s ability to meet its financial commitments.

Discontinued Operations

The following tables summarizes the liabilities of the discontinued operations as of September 30, 2021 and December 31, 2020 (in thousands):

| September 30, | December 31, | |||||||||||||

| 2021 | 2020 | |||||||||||||

| Liabilities | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Accrued expenses and other current liabilities | $ | $ | ||||||||||||

| Total current liabilities of discontinued operations | $ | $ | ||||||||||||

Aytu assumed sales returns of the Pediatric Portfolio made after the transaction close date related to sales prior to November 1, 2019 only to the extent such post-Closing sales returns exceed $2.0 million and are less than $2.8 million (in other words, Aytu will only assume $0.8 million of such returns). Therefore, Avalo is liable for future sales returns of the Pediatric Portfolio sold prior to the transaction close date in excess of the $0.8 million assumed by Aytu. The Company estimated future returns on sales made prior to the transaction close date as of September 30, 2021, which was recognized within accrued expenses and other current liabilities from discontinued operations (and shown in the table above).

Changes to the Company’s estimate of sales returns related to the Pediatric Portfolio is included within discontinued operations on the statement of operations and comprehensive loss and is shown within product revenue, net in the table summarizing the results of discontinued operations below. In future periods, as additional information becomes available, the Company expects to recognize expense (or a benefit) related to actual sales returns of the Pediatric Portfolio in excess (or less than) the returns reserve recorded, which will be recognized within discontinued operations. The Company expects this involvement to continue until sales returns are no longer accepted on sales of the Pediatric Portfolio made prior to November 1, 2019. Returns of these products may be accepted through the second quarter of 2022 (in line with the products’ return policies).

The following table summarizes the results of discontinued operations for the three and nine months ended September 30, 2021 and 2020 (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Product revenue, net | $ | $ | ( |

$ | $ | ( |

||||||||||||||||||||

| Operating expenses: | ||||||||||||||||||||||||||

| Sales and marketing | ||||||||||||||||||||||||||

| Total operating expenses | ||||||||||||||||||||||||||

| Other income: | ||||||||||||||||||||||||||

| Change in value of Guarantee | ||||||||||||||||||||||||||

| Total other income | ||||||||||||||||||||||||||

| Income (loss) from discontinued operations, net of tax | $ | $ | ( |

$ | $ | |||||||||||||||||||||

There were no non-cash operating items from discontinued operations for the nine months ended September 30, 2021 and no non-cash investing items from the discontinued operations for the nine months ended September 31, 2021 and 2020. The significant non-cash operating item from the discontinued operations for the nine months ended September 30, 2020 is contained below (in thousands).

12

| Nine Months Ended September 30, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Change in value of Guarantee | $ | ( |

||||||||||||

5. Net Loss Per Share

The Company computes earnings per share (“EPS”) using the two-class method. The two-class method of computing EPS is an earnings allocation formula that determines EPS for common stock and any participating securities according to dividends declared and participation rights in undistributed earnings.

The Company had two classes of stock outstanding during the nine months ended September 30, 2021; common stock and preferred stock. The preferred stock outstanding during the period had the same rights and preferences as the Company’s common stock, other than being non-voting, and is convertible into share of common stock on a 1-for-5 ratio. In April 2021, Armistice, which is a significant stockholder of the Company and whose chief investment officer, Steven Boyd, and managing director, Keith Maher, serve on the Board of the Company, converted the remaining 1,257,143 shares of convertible preferred stock into 6,285,715 shares of Avalo’s common stock (refer to Note 11 for more information). Therefore, the Company had only common stock outstanding during the three months ended September 30, 2021. Under the two-class method, the convertible preferred stock was considered a separate class of stock until the time it was converted to common shares for EPS purposes and therefore basic and diluted EPS is provided below for both common stock and preferred stock for the three months ended September 30, 2020 and the nine months ended September 30, 2020 and 2021.

EPS for common stock and EPS for preferred stock is computed by dividing the sum of distributed earnings and undistributed earnings for each class of stock by the weighted average number of shares outstanding for each class of stock for the period. In applying the two-class method, undistributed earnings are allocated to common stock and preferred stock based on the weighted average shares outstanding during the period, which assumes the convertible preferred stock has been converted to common stock. The weighted average number of common shares outstanding as of September 30, 2021 includes the weighted average effect of the pre-funded warrants issued in connection with the underwritten public offering that closed in January 2021, the exercise of which requires nominal consideration for the delivery of the shares of common stock (refer to Note 11 for more information).

Diluted net (loss) income per share includes the potential dilutive effect of common stock equivalents as if such securities were converted or exercised during the period, when the effect is dilutive. Common stock equivalents include: (i) outstanding stock options and restricted stock units, which are included under the “treasury stock method” when dilutive; and (ii) common stock to be issued upon the exercise of outstanding warrants, which are included under the “treasury stock method” when dilutive. Because the impact of these items is generally anti-dilutive during periods of net loss, there is no difference between basic and diluted loss per common share for periods with net losses. In periods of net loss, losses are allocated to the participating security only if the security has not only the right to participate in earnings, but also a contractual obligation to share in the Company’s losses.

The following tables set forth the computation of basic and diluted net (loss) income per share of common stock and preferred stock for the three and nine months ended September 30, 2021 and 2020 (in thousands, except share and per share amounts):

| Three Months Ended | ||||||||||||||

| September 30, 2021 | ||||||||||||||

| Common stock | ||||||||||||||

| Continuing Operations | Discontinued Operations | |||||||||||||

| Numerator: | ||||||||||||||

| Allocation of undistributed net loss | $ | ( |

$ | |||||||||||

| Denominator: | ||||||||||||||

| Weighted average shares | ||||||||||||||

| Basic and diluted net loss per share | $ | ( |

$ | |||||||||||

13

| Nine Months Ended | ||||||||||||||||||||||||||

| September 30, 2021 | ||||||||||||||||||||||||||

| Common stock | Preferred stock | |||||||||||||||||||||||||

| Continuing Operations | Discontinued Operations | Continuing Operations | Discontinued Operations | |||||||||||||||||||||||

| Numerator: | ||||||||||||||||||||||||||

| Allocation of undistributed net loss | $ | ( |

$ | $ | ( |

$ | ||||||||||||||||||||

| Denominator: | ||||||||||||||||||||||||||

| Weighted average shares | ||||||||||||||||||||||||||

| Basic and diluted net loss per share | $ | ( |

$ | $ | ( |

$ | ||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||

| September 30, 2020 | ||||||||||||||||||||||||||

| Common stock | Preferred stock | |||||||||||||||||||||||||

| Continuing Operations | Discontinued Operations | Continuing Operations | Discontinued Operations | |||||||||||||||||||||||

| Numerator: | ||||||||||||||||||||||||||

| Allocation of undistributed net loss | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Denominator: | ||||||||||||||||||||||||||

| Weighted average shares | ||||||||||||||||||||||||||

| Basic and diluted net loss per share | $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||

| Nine Months Ended | ||||||||||||||||||||||||||

| September 30, 2020 | ||||||||||||||||||||||||||

| Common stock | Preferred stock | |||||||||||||||||||||||||

| Continuing Operations | Discontinued Operations | Continuing Operations | Discontinued Operations | |||||||||||||||||||||||

| Numerator: | ||||||||||||||||||||||||||

| Allocation of undistributed net loss | $ | ( |

$ | $ | ( |

$ | ||||||||||||||||||||

| Denominator: | ||||||||||||||||||||||||||

| Weighted average shares | ||||||||||||||||||||||||||

| Basic and diluted net loss per share | $ | ( |

$ | $ | ( |

$ | ||||||||||||||||||||

The following outstanding securities have been excluded from the computation of diluted weighted shares outstanding for the three and nine months ended September 30, 2021 and 2020, as they could have been anti-dilutive:

| Three and Nine Months Ended | ||||||||||||||

| September 30, | ||||||||||||||

| 2021 | 2020 | |||||||||||||

| Stock options | ||||||||||||||

Warrants on common stock1

|

||||||||||||||

| Restricted Stock Units | ||||||||||||||

6. Asset Acquisition

14

In the first quarter of 2020, the Company consummated its merger with Aevi Genomic Medicine Inc. (“Aevi”), in which Avalo acquired the rights to AVTX-002, AVTX-006 and AVTX-007 (the “Merger” or the “Aevi Merger”).

The Merger consideration included (i) stock valued at approximately $15.5 million, resulting in the issuance of approximately 3.9 million shares of Avalo common stock to Aevi stockholders, (ii) forgiveness of $4.1 million the Company had loaned Aevi prior to the Merger closing, (iii) contingent value rights for up to an additional $6.5 million in subsequent payments based on certain development milestones (discussed further in Note 14), and (iv) transaction costs of $1.5 million.

7. Fair Value Measurements

ASC No. 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value as the price that would be received to sell an asset, or paid to transfer a liability, in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. The fair value standard also establishes a three‑level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

•Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market.

•Level 2—inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model‑derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability.

•Level 3—inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability.

The following table presents, for each of the fair value hierarchy levels required under ASC 820, the Company’s assets and liabilities that are measured at fair value on a recurring basis (in thousands):

| September 30, 2021 | ||||||||||||||||||||

| Fair Value Measurements Using | ||||||||||||||||||||

| Quoted prices in | Significant other | Significant | ||||||||||||||||||

| active markets for | observable | unobservable | ||||||||||||||||||

| identical assets | inputs | inputs | ||||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | ||||||||||||||||||

| Assets | ||||||||||||||||||||

| Investments in money market funds* | $ | $ | $ | |||||||||||||||||

| December 31, 2020 | ||||||||||||||||||||

| Fair Value Measurements Using | ||||||||||||||||||||

| Quoted prices in | Significant other | Significant | ||||||||||||||||||

| active markets for | observable | unobservable | ||||||||||||||||||

| identical assets | inputs | inputs | ||||||||||||||||||

| (Level 1) | (Level 2) | (Level 3) | ||||||||||||||||||

| Assets | ||||||||||||||||||||

| Investments in money market funds* | $ | $ | $ | |||||||||||||||||

*Investments in money market funds are reflected in cash and cash equivalents on the accompanying condensed consolidated balance sheets.

15

8. Leases

The Company currently occupies two leased properties, both of which serve as administrative office space. The Company determined that both of these leases are operating leases based on the lease classification test performed at lease commencement.

The annual base rent for the Company’s office located in Rockville, Maryland is $0.2 million, subject to annual 2.5 % increases over the term of the lease. The applicable lease provided for a rent abatement for a period of 12 months following the Company’s date of occupancy. The lease has an initial term of 10 years from the date the Company makes its first annual fixed rent payment, which occurred in January 2020. The Company has the option to extend the lease two times, each for a period of five years , and may terminate the lease as of the sixth anniversary of the first annual fixed rent payment, upon the payment of a termination fee. As of the lease commencement date, it was not reasonably certain that the Company will exercise the renewal periods or early terminate the lease and therefore the end date of the lease for accounting purposes is January 31, 2030.

The Company entered into a sublease for additional administrative office space in Chesterbrook, Pennsylvania in May 2020 (the “Chesterbrook Lease”). The annual base rent under the Chesterbrook Lease is $0.3 million. The lease expires on November 30, 2021.

In anticipation of the expiry of the Chesterbrook Lease on November 30, 2021, in September 2021, the Company entered into a lease for administrative office space in Chesterbrook, Pennsylvania that commences on December 1, 2021 (the “New Chesterbrook Lease”). The New Chesterbrook Lease has an initial term of 5.25 years from the lease commencement date. The initial annual base rent under the New Chesterbrook Lease is approximately $0.2 million. The Company will evaluate the accounting impact in the fourth quarter of 2021, including the lease classification test and the recognition of the lease right-of-use (“ROU”) asset and corresponding lease liability as of the lease commencement date on December 1, 2021. Therefore, the information contained below excludes the New Chesterbrook Lease.

Supplemental balance sheet information related to the leased properties (excluding the New Chesterbrook Lease) is as follows (in thousands):

| As of | ||||||||||||||

| September 30, 2021 | December 31, 2020 | |||||||||||||

| $ | $ | |||||||||||||

| $ | $ | |||||||||||||

| Total operating lease liabilities | $ | $ | ||||||||||||

The operating lease ROU assets are included in property and equipment and the lease liabilities are included in accrued expenses and other current liabilities and other long-term liabilities in our condensed consolidated balance sheets. The Company utilized a weighted average discount rate of 7.6 % to determine the present value of the lease payments. The weighted average remaining term of the operating leases at September 30, 2021 was 8.0 years.

16

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Operating lease cost* | $ | $ | $ | $ | ||||||||||||||||||||||

The following table shows a maturity analysis of the operating lease liabilities as of September 30, 20211 (in thousands):

| Undiscounted Cash Flows | ||||||||

| October 1, 2021 through December 31, 2021 | $ | |||||||

| 2022 | ||||||||

| 2023 | ||||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| Thereafter | ||||||||

| Total lease payments | $ | |||||||

| Less implied interest | ( |

|||||||

| Total | $ | |||||||

9. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities as of September 30, 2021 and December 31, 2020 consisted of the following (in thousands):

| As of | ||||||||||||||

| September 30, 2021 | December 31, 2020 | |||||||||||||

| Research and development | $ | $ | ||||||||||||

| Compensation and benefits | ||||||||||||||

| General and administrative | ||||||||||||||

| Sales and marketing | ||||||||||||||

| Commercial operations | ||||||||||||||

| Royalty payment | ||||||||||||||

| Lease liability, current | ||||||||||||||

| Other | ||||||||||||||

| Total accrued expenses and other current liabilities | $ | $ | ||||||||||||

10. Notes Payable

Overview

On June 4, 2021, the Company entered into a $35.0 million Loan Agreement with Horizon Technology Finance Corporation (“Horizon”) and Powerscourt Investments XXV, LP (“Powerscourt”, together with Horizon, the “Lenders”). In accordance with the Loan Agreement, $20.0 million of the $35.0 million was funded on the closing date (the “Initial Note”), with the remaining $15.0 million fundable upon the Company achieving certain predetermined milestones, which the Company met in the third quarter of 2021. On July 30, 2021, after achieving the predetermined milestones, the Company borrowed $10.0 million, which was evidenced by a second note payable (the “Second Note”). On September 29, 2021, after achieving the predetermined milestones, the Company borrowed the remaining $5.0 million, which was evidenced by a third note payable (the “Third Note”, and collectively with the Initial and Second Notes, the “Notes”).

17

Each advance under the Loan Agreement will mature 42 months from the first day of the month following the funding of the advance. Each advance accrues interest at a per annum rate of interest equal to 6.25 % plus the prime rate, as reported in the Wall Street Journal (subject to a floor of 3.25 %). The Loan Agreement provides for interest-only payments for each advance for the first 18 months, however the interest-only period was extended to 24 months as a result of the Company satisfying the Interest Only Extension Milestone (as defined in the Loan Agreement) in the third quarter of 2021. Thereafter, amortization payments will be payable in monthly installments of principal and interest through each advance’s maturity date. Upon ten business days’ prior written notice, the Company may prepay all of the outstanding advances by paying the entire principal balance and all accrued and unpaid interest, subject to prepayment charges of up to 3 % of the then outstanding principal balance. Upon the earlier of (i) payment in full of the principal balance, (ii) an event of default, or (iii) the maturity date, the Company will pay an additional final payment of 3 % of the principal loan amount to the Lenders.

Each advance of the loan is secured by a lien on substantially all of the assets of the Company, other than Intellectual Property and Excluded Collateral (in each case as defined in the Loan Agreement), and contains customary covenants and representations, including a financial reporting covenant and limitations on dividends, indebtedness, collateral, investments, distributions, transfers, mergers or acquisitions taxes, corporate changes, deposit accounts, and subsidiaries.

The events of default under the Loan Agreement include but are not limited to, failing to make a payment, breach of covenant, or occurrence of a material adverse change. If an event of default occurs, the Lenders are entitled to accelerate the loan amounts due, or take other enforcement actions. As of the filing date of this Quarterly Report on Form 10-Q, the Company was not aware of any breach of covenants nor received any notice of event of default from the Lenders.

On June 4, 2021, pursuant to the Loan Agreement, the Company issued warrants to the Lenders to purchase 403,844 shares of the Company’s common stock with an exercise price of $2.60 (the “Warrants”). The Warrants are exercisable for ten years from the date of issuance. The Lenders may exercise the Warrants either by (a) cash or check or (b) through a net issuance conversion. The Warrants, which met equity classification, were recognized as a component of permanent stockholders’ equity within additional paid-in-capital and were recorded at the issuance date using a relative fair value allocation method. The Company valued the Warrants at issuance, which resulted in a discount on the debt, and allocated the proceeds from the loan proportionately to the Notes and to the Warrants, of which $0.9 million was allocated to the Warrants.

For the nine months ended September 30, 2021, the Company incurred $2.1 million in debt issuance costs, including legal fees in connection with the Loan Agreement, fees paid directly to the lender, and other direct costs, of which $1.7 million were paid in the third quarter of 2021. All fees, warrants, and costs paid to the Lenders and all direct costs incurred by the Company are recognized as a debt discount and are amortized to interest expense using the effective interest method over the term of the loan. The Company did no t incur any debt issuance costs for the three months ended September 30, 2021.

The effective interest rate of the Notes, including the accretion of the final payment, was 13.5 % as of September 30, 2021.

Balance sheet information related to the note payable for the Notes is as follows (in thousands):

| As of | ||||||||||||||||||||

| September 30, 2021 | December 31, 2020 | Maturity | ||||||||||||||||||

| Initial Note | January 2025 | |||||||||||||||||||

| Second Note | February 2025 | |||||||||||||||||||

| Third Note | April 2025 | |||||||||||||||||||

Notes payable, gross1

|

||||||||||||||||||||

| Less: Unamortized debt discount and issuance costs | ||||||||||||||||||||

| Carrying value of notes payable, non-current | $ | $ | ||||||||||||||||||

1 Balance includes $1.1 million final payment fee for the Notes, which represents 3 % of the principal loan amount.

18

| As of September 30, 2021 | ||||||||||||||||||||

| 2021 | $ | |||||||||||||||||||

| 2022 | ||||||||||||||||||||

| 2023 | ||||||||||||||||||||

| 2024 | ||||||||||||||||||||

| 2025 | ||||||||||||||||||||

Total principal payments1

|

$ | |||||||||||||||||||

1 Balance includes $1.1 million final payment fee, which represents 3 % of the principal loan amount.

11. Capital Structure

Pursuant to the Company’s amended and restated certificate of incorporation, the Company is authorized to issue two classes of stock, common stock and preferred stock. At September 30, 2021, the total number of shares of capital stock the Company was authorized to issue was 205,000,000 of which 200,000,000 was common stock and 5,000,000 was preferred stock. All shares of common and preferred stock have a par value of $0.001

Common Stock

Q3 2021 Financing

On September 17, 2021, the Company closed an underwritten public offering of 14,308,878 shares of its common stock for net proceeds of $29.0 million. Armistice, which is a significant stockholder of the Company and whose chief investment officer, Steven Boyd, and managing director, Keith Maher, currently serve on the Board of the Company, participated in the offering by purchasing 5,454,545 shares of common stock, on the same terms as all other investors. Certain affiliates of Nantahala Capital Management LLC (collectively, “Nantahala”), which beneficially owned greater than 5 % of the Company’s outstanding common stock at the time of the offering, participated in the offering on the same terms as all other investors.

At-the-Market Offering Program

In July 2021, the Company entered into an “at-the-market” sales agreement with Cantor Fitzgerald & Co. and RBC Capital Markets, LLC (together, the “Agents”), pursuant to which the Company may sell from time to time, shares of its common stock having an aggregate offering price of up to $50.0 million through the Agents. In August 2021, the Company sold 2.0 million shares of common stock under the ATM Program for net proceeds of approximately $5.3 million.

Q2 2021 Debt Financing Agreement

As part of the Loan Agreement entered into in the second quarter of 2021, on June 4, 2021, the Company issued warrants to Horizon and Powerscourt to purchase 403,844 shares of the Company’s common stock with an exercise price of $2.60 . The warrants are exercisable for ten years from the date of issuance. Refer to Note 10 for additional information.

Q1 2021 Financing

In January 2021, the Company closed an underwritten public offering of 13,971,889 shares of its common stock and 1,676,923 pre-funded warrants for net proceeds of $37.7 million. Armistice participated in the offering by purchasing 2,500,000 shares of common stock, on the same terms as all other investors. Nantahala participated in the offering by purchasing 1,400,000 shares of common stock, on the same terms as all other investors.

Nantahala also purchased the pre-funded warrants to purchase up to an aggregate of 1,676,923 shares of common stock at a purchase price of $2.599 , which represents the per share public offering price for the common stock less the $0.001 per share exercise price for each pre-funded warrant.

The pre-funded warrants are exercisable at any time after their original issuance at the option of each holder, in such holder’s discretion, by (i) payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise or (ii) a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common

19

stock determined according to the formula set forth in the pre-funded warrant. A holder will not be entitled to exercise any portion of any pre-funded warrant if the holder’s ownership of the Company’s common stock would exceed 9.99 % following such exercise.

In the event of certain fundamental transactions, the holders of the pre-funded warrants will be entitled to receive upon exercise of the pre-funded warrants the kind of amounts of securities, cash or other property that the holders would have received had they exercised the pre-funded warrants immediately prior to such fundamental transaction without regard to any limitations on exercise contained in the pre-funded warrants.

The pre-funded warrants were classified as a component of permanent stockholders’ equity within additional paid-in capital and were recorded at the issuance date using a relative fair value allocation method. The pre-funded warrants are equity classified because they (i) are freestanding financial instruments that are legally detachable and separately exercisable from the equity instruments, (ii) are immediately exercisable, (iii) do not embody an obligation for the Company to repurchase its shares, (iv) permit the holders to receive a fixed number of shares of common stock upon exercise, (v) are indexed to the Company’s common stock and (vi) meet the equity classification criteria. In addition, such pre-funded warrants do not provide any guarantee of value or return. The Company valued the pre-funded warrants at issuance, concluding that their sales price approximated their fair value, and allocated net proceeds from the sale proportionately to the common stock and pre-funded warrants, of which $4.4 million was allocated to the pre-funded warrants and recorded as a component of additional paid-in capital.

2020 Financings

On June 11, 2020, the Company closed an underwritten public offering of 15,180,000 shares of its common stock for net proceeds of approximately $35.4 million. Armistice participated in the offering by purchasing 2,000,000 shares of common stock, on the same terms as all other investors. Additionally, certain of the Company’s officers participated in the offering by purchasing an aggregate of 110,000 shares of common stock, on the same terms as all other investors.

On March 17, 2020, the Company entered into a securities purchase agreement with Armistice pursuant to which the Company sold 1,951,219 shares of the Company’s common stock for net proceeds of approximately $3.9 million.

On February 6, 2020, the Company closed a registered direct offering with certain institutional investors for the sale by the Company of 1,306,282 shares of the Company’s common stock for net proceeds of approximately $5.1 million. Armistice participated in the offering by purchasing 1,256,282 shares of common stock from the Company, on the same terms as all other investors.

Aevi Merger

On February 3, 2020, under the terms of the Aevi Merger noted above in Note 6, the Company issued approximately 3.9 million shares of common stock.

Common Stock Warrants

At September 30, 2021, the following common stock warrants were outstanding:

| Number of common shares | Exercise price | Expiration | ||||||||||||

| underlying warrants | per share | date | ||||||||||||

| $ | May 2022 | |||||||||||||

| $ | June 2024 | |||||||||||||

| $ | — | |||||||||||||

| $ | June 2031 | |||||||||||||

Convertible Preferred Stock

On December 26, 2018, the Company filed a Certificate of Designation of Preferences of Series B Non-Voting Convertible Preferred Stock (“Series B Convertible Preferred Stock” or “convertible preferred stock”) of Avalo Therapeutics, Inc. (the “Certificate of Designation of the Series B Preferred Stock”) classifying and designating the rights, preferences and privileges of the Series B Convertible Preferred Stock. The Certificate of Designation of the Series B Convertible Preferred Stock authorized 2,857,143 shares of convertible preferred stock. The Series B Convertible Preferred Stock converted to shares of common stock on a 1-for-5 ratio and has the same rights, preferences, and privileges as common stock other than it held no voting rights. During the first quarter of 2020,

20

12. Stock-Based Compensation

2016 Equity Incentive Plan

On April 5, 2016, the Company’s board of directors adopted the 2016 Equity Incentive Plan (the “2016 Plan”) as the successor to the 2015 Omnibus Plan (the “2015 Plan”). The 2016 Plan was approved by the Company’s stockholders and became effective on May 18, 2016 (the “2016 Plan Effective Date”). Upon the 2016 Plan Effective Date, the 2016 Plan reserved and authorized up to 600,000 additional shares of common stock for issuance, as well as 464,476 unallocated shares remaining available for grant of new awards under the 2015 Plan. An Amended and Restated 2016 Equity Incentive Plan (the “2016 Amended Plan”) was approved by the Company’s stockholders in May 2018, which increased the share reserve by an additional 1.4 million shares. A Second Amended and Restated 2016 Equity Incentive Plan (the “2016 Second Amended Plan”) was approved by the Company’s stockholders in August 2019, which increased the share reserve by an additional 850,000 shares. A Third Amended and Restated Equity Incentive Plan (the “2016 Third Amended Plan”) was approved by the Company’s stockholders in June 2020 which increased the share reserve by an additional 2,014,400 shares. During the term of the 2016 Third Amended Plan, the share reserve will automatically increase on the first trading day in January of each calendar year ending on (and including) January 1, 2026, by an amount equal to 4 % of the total number of outstanding shares of common stock of the Company on the last trading day in December of the prior calendar year. As of September 30, 2021, there were 1,748,433 shares available for future issuance under the 2016 Third Amended Plan.

Option grants expire after ten years . Employee options typically vest over or four years . Employees typically receive a new hire option grant, as well as an annual grant in the first or second quarter of each year. Options granted to directors typically vest either immediately or over a period of or three years . Directors may elect to receive stock options in lieu of board compensation, which vest immediately. For stock options granted to employees and non-employee directors, the estimated grant date fair market value of the Company’s stock-based awards is amortized ratably over the individuals’ service periods, which is the period in which the awards vest. Stock-based compensation expense includes expense related to stock options, restricted stock units and employee stock purchase plan shares. The amount of stock-based compensation expense recognized for the three and nine months ended September 30, 2021 and 2020 was as follows (in thousands):

| Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||||||||||||

| Research and development | $ | $ | $ | $ | ||||||||||||||||||||||

| General and administrative | ||||||||||||||||||||||||||

| Sales and marketing | ||||||||||||||||||||||||||

| Total stock-based compensation | $ | $ | $ | $ | ||||||||||||||||||||||

In June 2021, the Company’s former Chairman of the Board resigned from the Board. The Company and the former Chairman subsequently entered into an agreement for him to serve as a strategic advisor to the Board and the Company, including serving on the Company’s Scientific Advisory Board, for a period of at least one year . As consideration for these services, the Company modified his outstanding stock option awards to allow them to continue to vest during the term during which he serves as a strategic advisor. Additionally, any option award previously granted was amended to extend the exercisability period. As a result of the modification, the Company recognized $1.4 million of compensation cost, $1.0 million of which related to options with market-based vesting conditions (which were fully vested prior to the modification) and $0.4 million of which related to options with service-based vesting conditions in the second quarter of 2021. This expense was recognized in general and administrative expenses. At September 30, 2021, there was $0.2 million of unrecognized compensation cost related to the modification of service-based options that will be recognized over a weighted-average period of 0.7 years.

Stock options with service-based vesting conditions

The Company has granted awards that contain service-based vesting conditions. The compensation cost for these options is recognized on a straight-line basis over the vesting periods. A summary of option activity for the nine months ended September 30, 2021 is as follows:

21

| Options Outstanding | ||||||||||||||||||||||||||

| Number of shares | Weighted average exercise price per share | Weighted average grant date fair value per share | Weighted average remaining contractual term (in years) | |||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | ||||||||||||||||||||||||

| Granted | $ | $ | ||||||||||||||||||||||||

| Exercised | ( |

$ | $ | |||||||||||||||||||||||

| Forfeited | ( |

$ | $ | |||||||||||||||||||||||

| Expired | ( |

$ | $ | |||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | ||||||||||||||||||||||||

| Exercisable at September 30, 2021 | $ | $ | ||||||||||||||||||||||||

In March 2021, the Company granted its newly appointed Chief Financial Officer options with service-based vesting conditions to purchase 0.5 million shares of common stock as an inducement option grant, pursuant to NASDAQ Listing Rule 5635(c)(4). In January 2021, the Company granted 2.7 million options with service-based vesting conditions to its employees as part of its annual stock option award.

In March 2020, our Chief Executive Officer entered into an amended employment agreement in which his salary in cash was reduced to $35,568 (the “Reduction”), which represents the minimum exempt annual salary. In consideration for the Reduction, on a quarterly basis, the Company grants stock options, which vest immediately, for the purchase of a number of shares of the Company’s common stock with a total value (based on the Black-Scholes valuation methodology) based on a pro rata total annual value of the foregone salary.

The aggregate intrinsic value of stock options is calculated as the difference between the exercise price of the stock options and the fair value of the Company’s common stock for those stock options that had exercise prices lower than the fair value of the Company’s common stock. As of September 30, 2021, the aggregate intrinsic value of options outstanding was $0.2 million. The aggregate intrinsic value of options currently exercisable as of September 30, 2021 was $0.2 million. There were 2,466,684 options that vested during the nine months ended September 30, 2021 with a weighted average exercise price of $3.64 per share. The total grant date fair value of shares which vested during the nine months ended September 30, 2021 was $5.6 million.

The Company recognized stock-based compensation expense of $1.7 million and $5.0 million related to stock options with service-based vesting conditions for the three and nine months ended September 30, 2021, respectively. At September 30, 2021, there was $14.8 million of total unrecognized compensation cost related to unvested service-based vesting condition awards. The unrecognized compensation cost is expected to be recognized over a weighted-average period of 2.8 years.

Stock-based compensation assumptions

The following table shows the assumptions used to compute stock-based compensation expense for stock options with service-based vesting conditions granted under the Black-Scholes valuation model for the nine months ended September 30, 2021:

| Service-based options | ||||||||

| Expected annual dividend yield | ||||||||

| Expected stock price volatility | ||||||||

| Expected term of option (in years) | ||||||||

| Risk-free interest rate | ||||||||

Stock options with market-based vesting conditions

22

| Options Outstanding | ||||||||||||||||||||||||||

| Number of shares | Weighted average exercise price per share | Weighted average remaining contractual term (in years) | Aggregate intrinsic value (1) | |||||||||||||||||||||||

| Balance at December 31, 2020 | $ | $ | ||||||||||||||||||||||||

| Granted | $ | |||||||||||||||||||||||||

| Balance at September 30, 2021 | $ | $ | ||||||||||||||||||||||||

| Exercisable at September 30, 2021 | $ | |||||||||||||||||||||||||

Restricted Stock Units

The Company measures the fair value of the restricted stock units using the stock price on the date of the grant. The restricted shares typically vest annually over a four-year period beginning on the first anniversary of the award. The following table summarizes the Company’s restricted stock unit (“RSU”) activity for the nine months ended September 30, 2021:

| RSUs Outstanding | ||||||||||||||

| Number of shares | Weighted average grant date fair value | |||||||||||||

| Unvested RSUs at December 31, 2020 | $ | |||||||||||||

| Vested | ( |

|||||||||||||

| Unvested RSUs at September 30, 2021 | $ | |||||||||||||

Employee Stock Purchase Plan

On April 5, 2016, the Company’s board of directors approved the 2016 Employee Stock Purchase Plan (the “ESPP”). The ESPP was approved by the Company’s stockholders and became effective on May 18, 2016 (the “ESPP Effective Date”).

Under the ESPP, eligible employees can purchase common stock through accumulated payroll deductions at such times as are established by the administrator. The ESPP is administered by the compensation committee of the Company’s board of directors. Under the ESPP, eligible employees may purchase stock at 85 % of the lower of the fair market value of a share of the Company’s common stock (i) on the first day of an offering period or (ii) on the purchase date. Eligible employees may contribute up to 15 % of their earnings during the offering period. The Company’s board of directors may establish a maximum number of shares of the Company’s common stock that may be purchased by any participant, or all participants in the aggregate, during each offering or offering period. Under the ESPP, a participant may not accrue rights to purchase more than $25,000 of the fair market value of the Company’s common stock for each calendar year in which such right is outstanding.

Upon the ESPP Effective Date, the Company reserved and authorized up to 500,000 shares of common stock for issuance under the ESPP. On January 1 of each calendar year, the aggregate number of shares that may be issued under the ESPP shall automatically increases by a number equal to the lesser of (i) 1 % of the total number of shares of the Company’s capital stock outstanding on December 31 of the preceding calendar year, and (ii) 500,000 shares of the Company’s common stock, or (iii) a number of shares of the Company’s common stock as determined by the Company’s board of directors or compensation committee. The number of shares were increased by 500,000 on January 1, 2021. As of September 30, 2021, 1,836,622 shares remained available for issuance.

In accordance with the guidance in ASC 718-50, Employee Share Purchase Plans, the ability to purchase shares of the Company’s common stock at the lower of the offering date price or the purchase date price represents an option and, therefore, the ESPP is a compensatory plan under this guidance. Accordingly, stock-based compensation expense is determined based on the option’s grant-date fair value and is recognized over the requisite service period of the option. The Company used the Black-Scholes valuation model and recognized stock-based compensation expense of $81 thousand and $170 thousand for the three and nine months ended September 30, 2021, respectively.

23

13. Income Taxes

14. Commitments and Contingencies

Litigation

Litigation - General

The Company may become party to various contractual disputes, litigation, and potential claims arising in the ordinary course of business. The Company currently does not believe that the resolution of such matters will have a material adverse effect on its financial position or results of operations except as otherwise disclosed in this report.

Karbinal Royalty Make-Whole Provision

In 2018, in connection with the acquisition of Avadel’s pediatric products, the Company entered into a supply and distribution agreement (the “Karbinal Agreement”) with TRIS Pharma Inc. (“TRIS”). As part of the Karbinal Agreement, the Company had an annual minimum sales commitment, which is based on a commercial year that spans from August 1 through July 31, of 70,000 units through 2025. The Company was required to pay TRIS a royalty make whole payment (“Make-Whole Payments”) of $30 for each unit under the 70,000 units annual minimum sales commitment through 2025.

As a part of the Aytu Divestiture, which closed on November 1, 2019, the Company assigned all payment obligations, including the Make-Whole Payments, under the Karbinal Agreement (collectively, the “TRIS Obligations”) to Aytu. However, under the original license agreement, the Company could ultimately be liable for the TRIS Obligations to the extent Aytu fails to make the required payments. The future Make-Whole Payments to be made by Aytu are unknown as the amount owed to TRIS is dependent on the number of units sold.

Possible Future Milestone Payments for In-Licensed Compounds

General

The Company is a party to license and development agreements with various third parties, which contain future payment obligations such as royalties and milestone payments (discussed further below). The Company recognizes a liability (and related expense) for each milestone if and when such milestone is probable and can be reasonably estimated. As typical in the biotechnology industry, each milestone has its own unique risks that the Company evaluates when determining the probability of achieving each milestone and the probability of success evolves over time as the programs progress and additional information is obtained. The Company considers numerous factors when evaluating whether a given milestone is probable including (but not limited to) the regulatory pathway, development plan, ability to dedicate sufficient funding to reach a given milestone and the probability of success.

AVTX-002 KKC License Agreement

On March 25, 2021, the Company entered into a license agreement with Kyowa Kirin Co., Ltd. (“KKC”) for exclusive worldwide rights to develop, manufacture and commercialize AVTX-002, KKC’s first-in-class fully human anti-LIGHT (TNFSF14) monoclonal antibody for all indications (the “KKC License Agreement”). The KKC License Agreement replaced the Amended and Restated Clinical Development and Option Agreement between the Company and KKC dated May 28, 2020.

Under the KKC License Agreement, the Company paid KKC an upfront license fee equal to $10.0 million. The Company is also required to pay KKC up to $112.5 million based on the achievement of specified development and regulatory milestones. Upon commercialization, the Company is required to pay KKC sales-based milestones aggregating up to $75 million tied to the achievement of annual net sales targets.

24