UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10‑Q

|

| |

þ

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the quarterly period ended March 31, 2019 |

OR |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-37590

CERECOR INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware (State of incorporation) | 45-0705648 (I.R.S. Employer Identification No.) |

540 Gaither Road, Suite 400 Rockville, Maryland 20850 (Address of principal executive offices) | (410) 522‑8707 (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, $0.001 par value

| CERC | Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b‑2 of the Exchange Act.

|

| | |

Large accelerated filer ¨ | | Accelerated filer ¨ |

Non-accelerated filer þ | | Smaller reporting company þ |

Emerging growth company þ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. þ

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ¨ No þ

As of May 3, 2019, the registrant had 42,753,659 shares of common stock outstanding.

CERECOR INC.

FORM 10-Q

For the Quarter Ended March 31, 2019

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Balance Sheets

|

| | | | | | | | |

| | March 31, 2019 | | December 31, 2018 |

| | (unaudited) | | |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 16,121,388 |

| | $ | 10,646,301 |

|

Accounts receivable, net | | 2,718,396 |

| | 3,157,555 |

|

Other receivables | | 5,531,025 |

| | 5,469,011 |

|

Inventory, net | | 1,046,982 |

| | 1,110,780 |

|

Prepaid expenses and other current assets | | 1,248,465 |

| | 1,529,516 |

|

Restricted cash, current portion | | 77,846 |

| | 18,730 |

|

Total current assets | | 26,744,102 |

| | 21,931,893 |

|

Property and equipment, net | | 1,477,067 |

| | 586,512 |

|

Intangibles assets, net | | 30,160,621 |

| | 31,239,468 |

|

Goodwill | | 16,411,123 |

| | 16,411,123 |

|

Restricted cash, net of current portion | | 77,118 |

| | 81,725 |

|

Total assets | | $ | 74,870,031 |

| | $ | 70,250,721 |

|

Liabilities and stockholders’ equity | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 1,249,470 |

| | $ | 1,446,141 |

|

Accrued expenses and other current liabilities | | 21,815,097 |

| | 19,731,373 |

|

Income taxes payable | | 1,814,650 |

| | 2,032,258 |

|

Long-term debt, current portion | | 1,050,000 |

| | 1,050,000 |

|

Contingent consideration, current portion | | 2,205,647 |

| | 1,956,807 |

|

Total current liabilities | | 28,134,864 |

| | 26,216,579 |

|

Long-term debt, net of current portion | | 14,303,540 |

| | 14,327,882 |

|

Contingent consideration, net of current portion | | 6,796,641 |

| | 7,093,757 |

|

Deferred tax liability, net | | 75,179 |

| | 69,238 |

|

License obligations | | 1,250,000 |

| | 1,250,000 |

|

Other long-term liabilities | | 1,189,277 |

| | 385,517 |

|

Total liabilities | | 51,749,501 |

| | 49,342,973 |

|

Stockholders’ equity: | | | | |

Common stock—$0.001 par value; 200,000,000 shares authorized at March 31, 2019 and December 31, 2018; 42,753,659 and 40,804,189 shares issued and outstanding at March 31, 2019 and December 31, 2018, respectively | | 42,754 |

| | 40,804 |

|

Preferred stock—$0.001 par value; 5,000,000 shares authorized at March 31, 2019 and December 31, 2018; 2,857,143 shares issued and outstanding at March 31, 2019 and December 31, 2018 | | 2,857 |

| | 2,857 |

|

Additional paid-in capital | | 128,747,037 |

| | 119,082,157 |

|

Accumulated deficit | | (105,672,118 | ) | | (98,218,070 | ) |

Total stockholders’ equity | | 23,120,530 |

| | 20,907,748 |

|

Total liabilities and stockholders’ equity | | $ | 74,870,031 |

| | $ | 70,250,721 |

|

See accompanying notes to the condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Operations (Unaudited)

|

| | | | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2019 | | 2018 |

Revenues | | | | |

Product revenue, net | | $ | 5,411,443 |

| | $ | 4,260,119 |

|

Sales force revenue | | — |

| | 222,656 |

|

Total revenues, net | | 5,411,443 |

| | 4,482,775 |

|

| | | | |

Operating expenses: | | | | |

Cost of product sales | | 1,947,892 |

| | 863,624 |

|

Research and development | | 3,401,189 |

| | 1,649,778 |

|

General and administrative | | 2,716,983 |

| | 2,918,916 |

|

Sales and marketing | | 3,108,902 |

| | 1,524,816 |

|

Amortization expense | | 1,078,847 |

| | 1,017,408 |

|

Change in fair value of contingent consideration | | 180,402 |

| | 262,769 |

|

Total operating expenses | | 12,434,215 |

| | 8,237,311 |

|

Loss from operations | | (7,022,772 | ) | | (3,754,536 | ) |

Other (expense) income: | | | | |

Change in fair value of warrant liability and unit purchase option liability | | (47,577 | ) | | (23,251 | ) |

Other (expense) income, net | | (9,400 | ) | | 18,655 |

|

Interest expense, net | | (207,941 | ) | | (100,402 | ) |

Total other expense, net | | (264,918 | ) | | (104,998 | ) |

Net loss before taxes | | (7,287,690 | ) | | (3,859,534 | ) |

Income tax expense | | 166,358 |

| | 23,313 |

|

Net loss | | $ | (7,454,048 | ) | | $ | (3,882,847 | ) |

Net loss per share of common stock, basic and diluted | | $ | (0.13 | ) | | $ | (0.12 | ) |

Net loss per share of preferred stock, basic and diluted | | $ | (0.67 | ) | | $ | — |

|

See accompanying notes to the condensed consolidated unaudited financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows (Unaudited)

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

Operating activities | | | | |

Net loss | | $ | (7,454,048 | ) | | $ | (3,882,847 | ) |

Adjustments to reconcile net loss provided by (used in) to net cash used in operating activities: | | | | |

Depreciation and amortization | | 1,098,478 |

| | 1,023,040 |

|

Stock-based compensation | | 596,693 |

| | 242,824 |

|

Deferred taxes | | 5,941 |

| | 15,913 |

|

Amortization of inventory fair value associated with acquisition of TRx and Avadel | | 22,603 |

| | 45,450 |

|

Non-cash interest expense | | — |

| | 105,451 |

|

Change in fair value of warrant liability and unit purchase option liability | | 47,577 |

| | 23,251 |

|

Change in fair value of contingent consideration and long-term royalty obligation | | 180,402 |

| | 262,769 |

|

Other | | 21,412 |

| | — |

|

Changes in assets and liabilities: | | | | |

Accounts receivable, net | | 439,159 |

| | 104,671 |

|

Other receivables | | (62,014 | ) | | 371,663 |

|

Inventory, net | | 41,195 |

| | (554,445 | ) |

Prepaid expenses and other assets | | 281,051 |

| | (71,085 | ) |

Escrowed cash receivable | | — |

| | (2,065 | ) |

Accounts payable | | (196,671 | ) | | 1,866,960 |

|

Income taxes payable | | (217,608 | ) | | 7,400 |

|

Accrued expenses and other liabilities | | 2,074,278 |

| | 160,627 |

|

Net cash used in operating activities | | (3,121,552 | ) | | (280,423 | ) |

Investing activities | | | | |

Acquisition of business | | — |

| | (1 | ) |

Purchase of property and equipment | | (165,969 | ) | | (19,224 | ) |

Net cash used in investing activities | | (165,969 | ) | | (19,225 | ) |

Financing activities | | | | |

Proceeds from exercise of stock options and warrants | | 94,177 |

| | 363,390 |

|

Proceeds from underwritten public offering, net | | 8,975,960 |

| | — |

|

Payment of contingent consideration | | (228,678 | ) | | — |

|

Payment of long-term debt | | (24,342 | ) | | — |

|

Net cash provided by financing activities | | 8,817,117 |

| | 363,390 |

|

Increase in cash, cash equivalents and restricted cash | | 5,529,596 |

| | 63,742 |

|

Cash, cash equivalents, and restricted cash at beginning of period | | 10,746,756 |

| | 2,605,499 |

|

Cash, cash equivalents, and restricted cash at end of period | | $ | 16,276,352 |

| | $ | 2,669,241 |

|

Supplemental disclosures of cash flow information | | | | |

Cash paid for interest | | $ | 262,500 |

| | $ | 44,003 |

|

Cash paid for taxes | | $ | 378,025 |

| | $ | — |

|

Supplemental disclosures of non-cash activities | | | | |

Leased asset obtained in exchange for new operating lease liability | | $ | 743,025 |

| | $ | — |

|

Debt assumed in Avadel Pediatric Products acquisition | | $ | — |

| | $ | (15,075,000 | ) |

The following table provides a reconciliation of cash, cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows:

|

| | | | | | | | |

| | March 31, |

| | 2019 | | 2018 |

| | | | |

Cash and cash equivalents | | $ | 16,121,388 |

| | $ | 2,523,927 |

|

Restricted cash, current | | 77,846 |

| | 13,955 |

|

Restricted cash, non-current | | 77,118 |

| | 131,359 |

|

Total cash, cash equivalents and restricted cash | | $ | 16,276,352 |

| | $ | 2,669,241 |

|

See accompanying notes to the condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Condensed Consolidated Statements of Changes in Stockholders’ Equity

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Stockholders’ Equity |

| | | | | Additional | | | | | | Total |

| Common stock | | Preferred Stock | | paid‑in | | Contingently issuable stock | | Accumulated | stockholders’ |

| Shares | | Amount | | Shares | | Amount | | capital | | Amount | | deficit | | equity |

Three Months Ended March 31, 2018: | | | | | | | | | | | | | | | |

Balance, December 31, 2017 | 31,266,989 |

| | $ | 31,268 |

| | — |

| | $ | — |

| | $ | 83,338,136 |

| | $ | 2,655,464 |

| | $ | (58,165,260 | ) | | $ | 27,859,608 |

|

Exercise of stock options and warrants | 143,346 |

| | 143 |

| | — |

| | — |

| | 363,247 |

| | | | | | 363,390 |

|

Stock-based compensation | — |

| | — |

| | — |

| | — |

| | 242,824 |

| | — |

| | — |

| | 242,824 |

|

Net loss | — |

| | — |

| | — |

| | — |

| | — |

| | | | (3,882,847 | ) | | (3,882,847 | ) |

Balance, March 31, 2018 | 31,410,335 |

| | $ | 31,411 |

| | — |

| | $ | — |

| | $ | 83,944,207 |

| | $ | 2,655,464 |

| | $ | (62,048,107 | ) | | $ | 24,582,975 |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three Months Ended March 31, 2019: | | | | | | | | | | | | | | | |

Balance, December 31, 2018 | 40,804,189 |

| | $ | 40,804 |

| | 2,857,143 |

| | $ | 2,857 |

| | $ | 119,082,157 |

| | $ | — |

| | $ | (98,218,070 | ) | | $ | 20,907,748 |

|

Issuance of shares of common stock in underwritten public offering, net of offering costs | 1,818,182 |

| | 1,818 |

| | — |

| | — |

| | 8,974,142 |

| | — |

| | | | 8,975,960 |

|

Exercise of stock options and warrants | 31,288 |

| | 31 |

| | — |

| | — |

| | 94,146 |

| | — |

| | | | 94,177 |

|

Stock-based compensation | — |

| | — |

| | — |

| | — |

| | 596,693 |

| | — |

| | — |

| | 596,693 |

|

Restricted Stock Units vested during period | 100,000 |

| | 101 |

| | — |

| | — |

| | (101 | ) | | — |

| | — |

| | — |

|

Net loss | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (7,454,048 | ) | | (7,454,048 | ) |

Balance, March 31, 2019 | 42,753,659 |

| | $ | 42,754 |

| | 2,857,143 |

| | $ | 2,857 |

| | $ | 128,747,037 |

| | $ | — |

| | $ | (105,672,118 | ) | | $ | 23,120,530 |

|

See accompanying notes to the condensed consolidated financial statements.

CERECOR INC. and SUBSIDIARIES

Notes to Unaudited Condensed Consolidated Financial Statements

1. Business

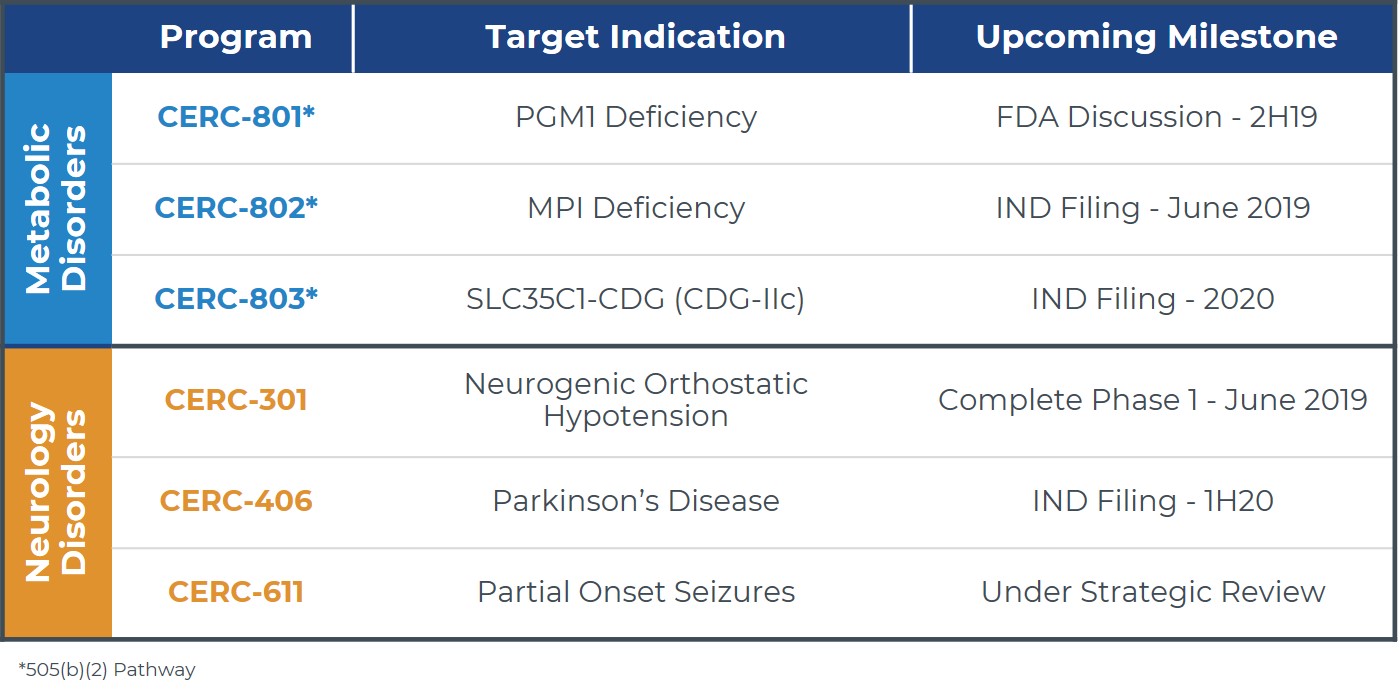

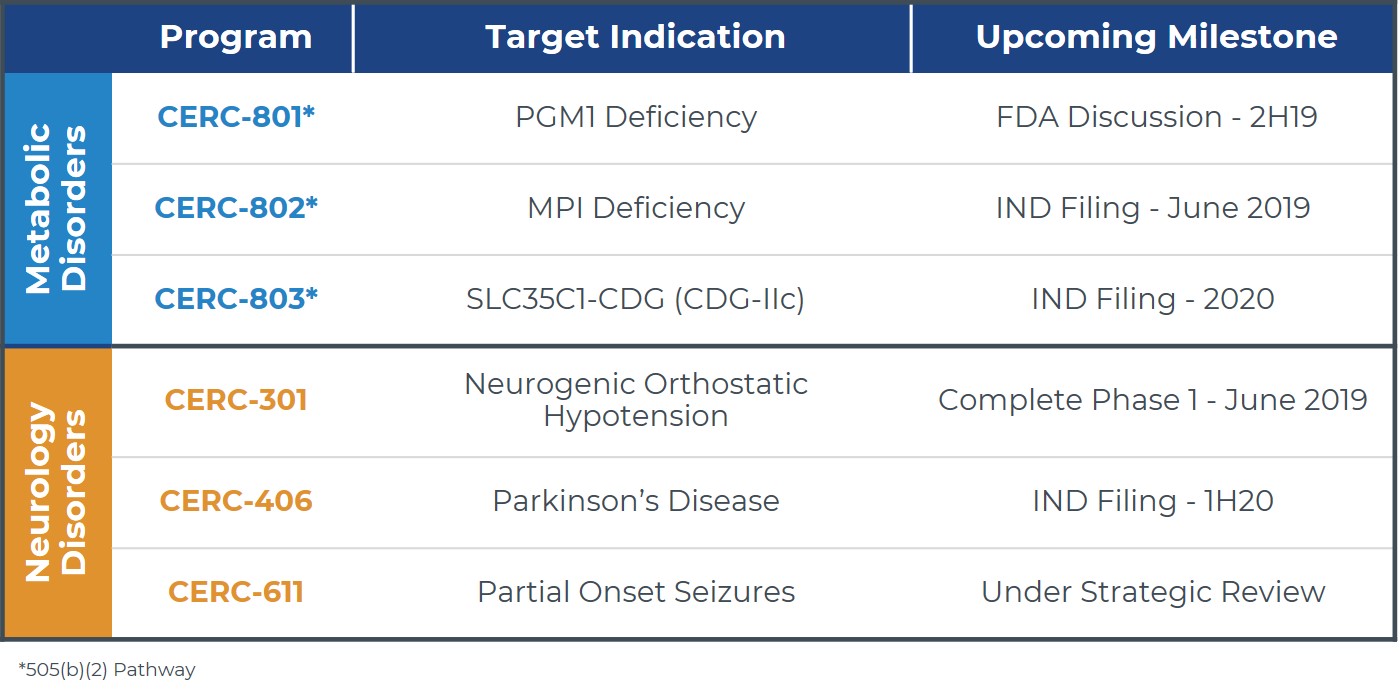

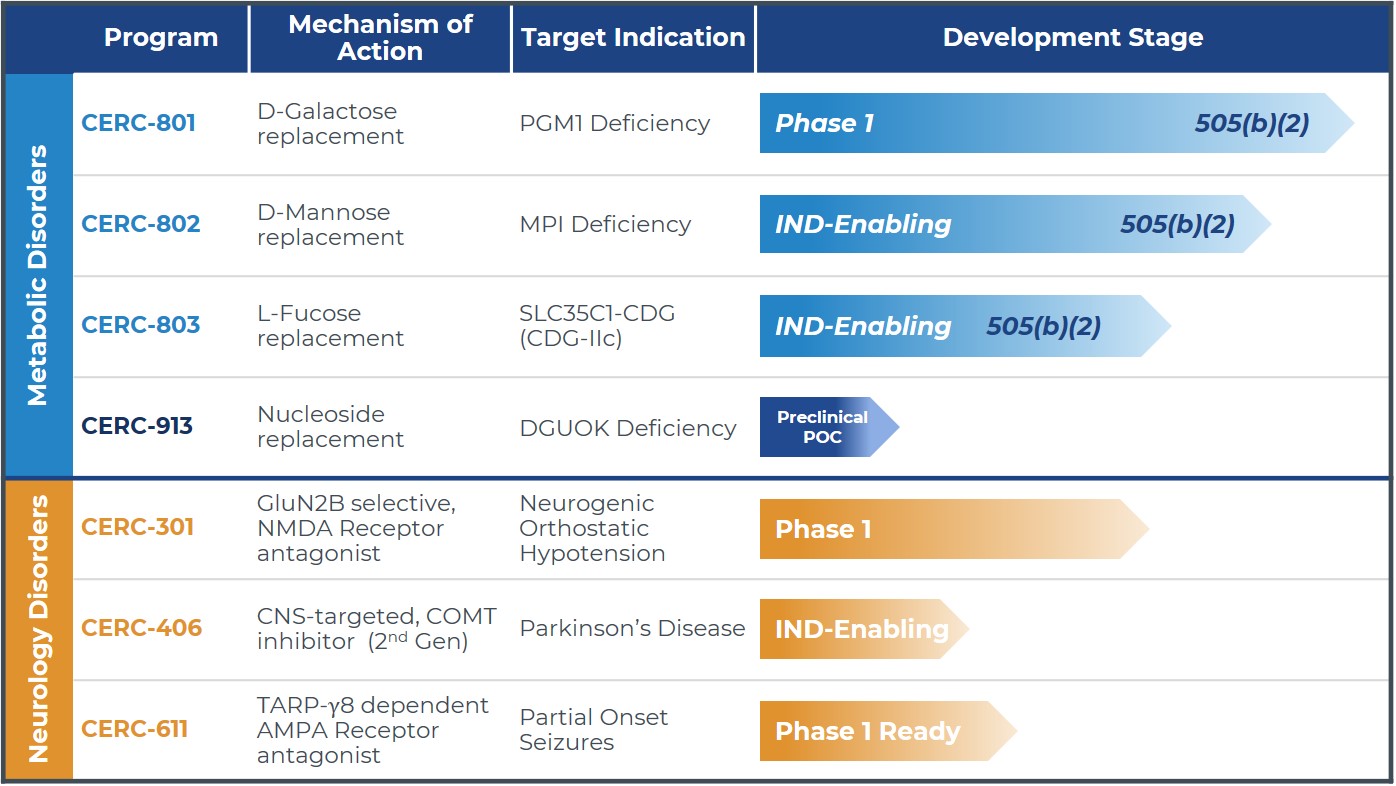

Cerecor Inc. (the "Company" or “Cerecor”) is a fully integrated biopharmaceutical company with commercial operations and research and development capabilities. The Company is building a pipeline of innovative therapies in neurology, pediatric healthcare, and orphan rare diseases. The Company's neurology pipeline is led by CERC-301, which recently received positive interim results from the Phase I safety study of Neurogenic Orthostatic Hypotension ("nOH"). The Company is also developing two other neurological compounds, one of which is in preclinical testing and the other is in the clinical ready stage. The Company's pediatric orphan rare disease pipeline is led by CERC-801, CERC-802, and CERC-803. All three of these compounds are therapies for inherited metabolic disorders known as Congenital Disorders of Glycosylation ("CDGs") by means of substrate replacement therapy. The U.S. Food and Drug Administration ("FDA") has granted Rare Pediatric Disease designation ("RPDD") and Orphan Drug Designation ("ODD") to all three compounds. Under the FDA’s Rare Pediatric Disease Priority Review Voucher ("PRV") program, upon the approval of a new drug application ("NDA") for the treatment of a rare pediatric disease, the sponsor of such application would be eligible for a PRV that can be used to obtain priority review for a subsequent new drug application or biologics license application. The PRV may be sold or transferred an unlimited number of times. The Company plans to leverage the 505(b)(2) NDA pathway for all three compounds to accelerate development and approval. The Company is also in the process of developing one other preclinical pediatric orphan rare disease compound.

The Company also has a diverse portfolio of marketed products. Our marketed products are led by our prescribed dietary supplements and prescribed drugs. Our prescribed dietary supplements include Poly-Vi-Flor and Tri-Vi-Flor, which are prescription vitamin and fluoride supplements used in infants and children to treat or prevent deficiency of essential vitamins and fluoride. The Company also markets a number of prescription drugs that treat a range of pediatric diseases, disorders and conditions. Cerecor's prescription drugs include Millipred®, Ulesfia®, Karbinal™ ER, AcipHex® Sprinkle™, and Cefaclor for Oral Suspension. Finally, the Company has one marketed medical device, Flexichamber™.

Cerecor was incorporated in 2011, commenced operations in the second quarter of 2011 and completed an initial public offering in October 2015.

On November 17, 2017, the Company acquired TRx Pharmaceuticals, LLC (“TRx”) and its wholly-owned subsidiaries (see "TRx Acquisition" in Note 5 below for a description of this transaction).

On February 16, 2018, Cerecor acquired all rights to Avadel Pharmaceuticals PLC’s (“Avadel”) marketed pediatric products (the “Acquired Products”) in exchange for Cerecor assuming certain financial obligations of Avadel (see "Avadel Pediatric Products Acquisition" in Note 5 below for a description of this transaction).

On September 25, 2018, the Company acquired Ichorion Therapeutics, Inc., a privately-held biopharmaceutical company focused on developing treatments and increasing awareness of inherited metabolic disorders known as CDGs (see "Ichorion Asset Acquisition" in Note 5 below for a description of this transaction).

Liquidity

In order to meet its cash flow needs, the Company applies a disciplined decision-making methodology as it evaluates the optimal allocation of the Company's resources between investing in the Company's current commercial product line, the Company's development portfolio and acquisitions or in-licensing of new assets. For the three months ended March 31, 2019, Cerecor generated a net loss of $7.5 million and negative cash flow from operations of $3.1 million. As of March 31, 2019, Cerecor had an accumulated deficit of $105.7 million and a balance of $16.1 million in cash and cash equivalents. During the first quarter of 2019, the Company closed an underwritten public offering of common stock for 1,818,182 shares of common stock of the Company, at a price to the public of $5.50 per share ("public price"). Armistice Capital Master Fund Ltd. ("Armistice"), our largest stockholder, participated in the offering by purchasing 363,637 shares of common stock of the Company from the underwriter at the public price. Cerecor director Steven J. Boyd is Armistice's Chief Investment Officer. The net proceeds of the offering were approximately $9.0 million (see "Common Stock Offering" in Note 9 below for description of the transaction).

The Company plans to use cash and the anticipated cash flows from the Company's existing product sales to offset costs related to its neurology programs, pediatric rare disease programs, business development, costs associated with its organizational

infrastructure, and debt principal and interest payments. Cerecor expects to continue to incur significant expenses and operating losses for the immediate future as it continues to invest in the Company's pipeline assets. Our ability to achieve and maintain profitability in the future is dependent on, among other things, the development, regulatory approval, and commercialization of our new product candidates and achieving a level of revenues from our existing product sales adequate to support our cost structure, which includes significant investment in our pipeline assets.

The Company believes it will require additional financing to continue to execute its clinical development strategy and fund future operations. The Company plans to meet its capital requirements through operating cash flows from product sales and some combination of equity or debt financings, collaborations, out-licensing arrangements, strategic alliances, federal and private grants, marketing, distribution, or licensing arrangements, or the sale of current or future assets. If the Company is not able to secure adequate additional funding, the Company may be forced to make reductions in spending, extend payment terms with suppliers, liquidate assets where possible, or suspend or curtail planned programs. If the Company raises additional funds through collaborations, strategic alliances, or licensing arrangements with third parties, the Company may have to relinquish valuable rights to our technologies, future revenue streams, research programs, or product candidates.

Our plan to aggressively develop our pipeline will require substantial cash inflows in excess of what the Company expects our current commercial operations to generate. However, the Company expects that our existing cash and cash equivalents, together with anticipated revenue, will enable us to fund our operating expenses, capital expenditure requirements, and other non-operating cash payments, such as fixed quarterly payments on our outstanding debt balances, through at least May 2020.

2. Basis of Presentation and Significant Accounting Policies

Basis of Presentation

The Company’s unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of the Financial Accounting Standards Board (“FASB”).

In the opinion of management, the accompanying unaudited condensed consolidated financial statements include all adjustments, consisting of normal recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and cash flows. The condensed consolidated balance sheet at December 31, 2018 has been derived from audited financial statements at that date. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and Exchange Commission (“SEC”). Certain prior period amounts have been reclassified to conform to the current year presentation.

The Company believes that the disclosures provided herein are adequate to make the information presented not misleading when these unaudited condensed consolidated financial statements are read in conjunction with the December 31, 2018 audited consolidated financial statements.

Reclassification

During the fourth quarter of 2018, the Company concluded that going forward it would include change in fair value of contingent consideration within its own stand-alone line in operating expenses in the Company's statements of operations. The Company has reclassified $0.3 million from other expenses to operating expenses in the March 31, 2018 statement of operations to conform with current period presentation.

Significant Accounting Policies

During the three months ended March 31, 2019, there have been no significant changes to the Company’s summary of significant accounting policies contained in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018, as filed with the SEC on March 18, 2019 and amended on April 23, 2019, except for the recently adopted accounting standards described below.

The following significant accounting policy was updated in 2019 to reflect changes upon our adoption of ASU No. 2016-02, Leases (Topic 842) ("ASU 2016-02").

Leases

The Company determines if an arrangement is a lease at inception. If an arrangement contains a lease, the Company performs a lease classification test to determine if the lease is an operating lease or a finance lease. The Company has identified one operating lease for its corporate headquarters. Right-of-use ("ROU") assets represent the right to use an underlying asset for the lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Operating lease liabilities are recognized on the commencement date of the lease based on the present value of the future lease payments over the lease term and are included in other long-term liabilities on our condensed consolidated balance sheet. Right-of-use assets are valued at the initial measurement of the lease liability, plus any indirect costs or rent prepayments, and reduced by any lease incentives and any deferred lease payments. Operating right-of-use assets are recorded in property and equipment, net on the condensed consolidated balance sheet and are amortized over the lease term. To determine the present value of lease payments on lease commencement, we use the implicit rate when readily determinable, however as most leases do not provide an implicit rate, we use our incremental borrowing rate based on information available at commencement date. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Furthermore, the Company has elected the practical expedient to account for the lease and non-lease components as a single lease component for the leased property asset class. Lease expense is recognized on a straight-line basis over the life of the lease and is included within general and administrative expenses.

Recently Adopted Accounting Pronouncements

Adoption of ASC 842

In February 2016, FASB issued ASU No. 2016-02, Leases (Topic 842) ("ASU 2016-02"). This guidance revises existing practice related to accounting for leases under ASC No. 840, Leases (“ASC 840”) for both lessees and lessors. The new guidance in ASU 2016-02 requires lessees to recognize a right-of-use asset and a lease liability for nearly all leases (other than leases that meet the definition of a short-term lease). The lease liability will be equal to the present value of lease payments and the right-of-use asset will be based on the lease liability, subject to adjustment such as for initial direct costs. For income statement purposes, the new standard retains a dual model similar to ASC 840, requiring leases to be classified as either operating leases or finance leases. For lessees, operating leases will result in straight-line expense (similar to current accounting by lessees for operating leases under ASC 840) while finance leases will result in a front-loaded expense pattern (similar to current accounting by lessees for capital leases under ASC 840).

The Company adopted the standard using the simplified transition method on its effective date of January 1, 2019 and therefore did not adjust prior comparative periods as permitted by the codification improvements issued by FASB in July 2018. Additionally, the Company elected the package of practical expedients permitted under the transition guidance within the new standard, which among other things, allows the Company to carryforward the historical lease classification. As a result of the standard, the Company recorded a lease liability of $1.2 million and a right-of-use asset of $0.7 million, which is equal to the initial measurement of the lease liability reduced by the unamortized balance of lease incentive received and deferred rent. There was no material impact to our condensed consolidated income statement (see Note 12 below for more information).

Other Adopted Accounting Pronouncements

In August 2018, the SEC adopted the final rule under SEC Release No. 33-10532 Disclosure Update and Simplification, to eliminate or modify certain disclosure rules that are redundant, outdated, or duplicative of GAAP or other regulatory requirements. Among other changes, the amendments provide that disclosure requirements related to the analysis of stockholders' equity are expanded for interim financial statements. An analysis of the changes in each caption of stockholders' equity presented in the balance sheet must be provided in a note or separate statement. The Company has provided this disclosure beginning in the first quarter of 2019.

3. Revenue from Contracts with Customers

The Company generates substantially all of its revenue from sales of prescription pharmaceutical products to its customers. The following table presents net revenues disaggregated by type (in thousands):

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

Prescribed dietary supplements | | $ | 1,791 |

| | $ | 2,231 |

|

Prescription drugs | | 3,620 |

| | 2,029 |

|

Sales force revenue | | — |

| | 223 |

|

Total revenue | | $ | 5,411 |

| | $ | 4,483 |

|

As is typical in the pharmaceutical industry, the Company sells its prescription pharmaceutical products (which include prescribed dietary supplements and prescription drugs) in the United States primarily through wholesale distributors and a specialty contracted pharmacy. Wholesale distributors account for substantially all of the Company’s net product revenues and trade receivables. In addition, the Company earns revenue from sales of its prescription pharmaceutical products directly to retail pharmacies. For the three months ended March 31, 2019, the Company’s three largest customers accounted for approximately 35%, 33%, and 25%, respectively, of the Company's total net product revenues from sale of prescription pharmaceutical products.

4. Net Loss Per Share

The Company computes earnings per share ("EPS") using the two-class method. The two-class method of computing EPS is an earnings allocation formula that determines EPS for common stock and any participating securities according to dividends declared and participation rights in undistributed earnings. The Company has two classes of stock outstanding, common stock and preferred stock. The preferred stock was issued in the fourth quarter of 2018 upon Armistice exercising preferred stock warrants to acquire an aggregate of 2,857,143 shares of the Series B Convertible Preferred Stock ("convertible preferred stock"). The convertible preferred stock has the same rights and preferences as common stock other than being non-voting and convertible to shares of common stock on a 1-to-5 ratio.

Under the two-class method, the convertible preferred stock is considered a separate class of stock for EPS purposes and therefore basic and diluted EPS is provided below for both common stock and preferred stock. EPS for common stock and EPS for preferred stock is computed by dividing the sum of distributed earnings and undistributed earnings for each class of stock by the weighted average number of shares outstanding for each class of stock for the period. In applying the two-class method, undistributed earnings are allocated to common stock and preferred stock based on the weighted average shares outstanding during the period, which assumes the convertible preferred stock has been converted to common stock.

Diluted net (loss) income per share includes the potential dilutive effect of common stock equivalents as if such securities were converted or exercised during the period, when the effect is dilutive. Common stock equivalents include: (i) outstanding stock options and restricted stock units, which are included under the "treasury stock method" when dilutive, (ii) common stock to be issued upon the assumed conversion of the Company's unit purchase option shares, which are included under the "if-converted method" when dilutive; (iii) prior to issuance, the contingently issuable shares in the TRx acquisition, if contingencies would have been satisfied if the end of the contingency period were as of the balance sheet date under the "if-converted method" when dilutive; and (iv) common stock to be issued upon the exercise of outstanding warrants, which are included under the "treasury stock method" when dilutive. Because the impact of these items is generally anti-dilutive during periods of net loss, there is no difference between basic and diluted loss per common share for periods with net losses. In periods of net loss, losses are allocated to the participating security only if the security has not only the right to participate in earnings, but also a contractual obligation to share in the Company's losses.

The following table sets forth the computation of basic and diluted net loss per share of common stock and preferred stock for the three months ended March 31, 2019 and 2018, which includes both classes of participating securities:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended |

| | March 31, | | March 31, |

| | 2019 | | 2018 |

| | Common stock | | Preferred stock | | Common stock | | Preferred stock |

Net loss per share, basic and diluted | | | | | | | | |

Numerator: | | | | | | | | |

Allocation of undistributed net loss | | $ | (5,537,787 | ) | | $ | (1,916,261 | ) | | $ | (3,882,847 | ) | | $ | — |

|

Denominator: | | | | | | | | |

Weighted average shares | | 41,284,168 |

| | 2,857,143 |

| | 31,316,246 |

| | — |

|

Basic and diluted net loss per share | | $ | (0.13 | ) | | $ | (0.67 | ) | | $ | (0.12 | ) | | $ | — |

|

| | | | | | | | |

The following outstanding securities at March 31, 2019 and 2018 have been excluded from the computation of diluted weighted shares outstanding, as they could have been anti-dilutive:

|

| | | | | | |

| | Three Months Ended |

| | March 31, |

| | 2019 | | 2018 |

Stock options | | 4,345,305 |

| | 3,909,384 |

|

Warrants on common stock | | 4,024,708 |

| | 18,986,659 |

|

Restricted Stock Units | | 345,000 |

| | — |

|

Underwriters' unit purchase option | | 40,000 |

| | 40,000 |

|

5. Acquisitions

Ichorion Asset Acquisition

On September 24, 2018, the Company entered into, and subsequently consummated the transactions contemplated by, an agreement and plan of merger (the "Merger Agreement") by and among the Company and Ichorion Therapeutics, Inc., a Delaware corporation (the “Ichorion Asset Acquisition”), with Ichorion surviving as a wholly owned subsidiary of the Company. The consideration for the Ichorion Asset Acquisition consisted of approximately 5.8 million shares of the Company’s common stock, par value $0.001 per share, as adjusted for Estimated Working Capital as defined in the Merger Agreement. The shares of common stock issued as part of the acquisition may not be resold until January 2020. Consideration for the Ichorion Asset Acquisition includes certain development milestones worth up to an additional $15 million, payable either in shares of the Company's common stock or in cash, at the election of the Company.

The fair value of the common stock shares transferred at closing was approximately $20 million based on the Company's stock price close on September 24, 2018 and offset by an estimated discount for lack of marketability calculated using guideline public company volatility for comparable companies. The assets acquired consisted primarily of $18.7 million of IPR&D, $1.6 million of cash and $0.2 million assembled workforce. The Company recorded this transaction as an asset purchase as opposed to a business combination as management concluded that substantially all of the value received was related to one group of similar identifiable assets, which was the IPR&D for the three preclinical therapies for inherited metabolic disorders known as CDGs (CERC-801, CERC-802, and CERC-803). The Company has considered these assets similar due to similarities in the risks for development, compound type, stage of development, regulatory pathway, patient population and economics of commercialization. The fair value of the IPR&D was immediately recognized as Acquired In-Process Research and Development expense as the IPR&D asset has no other alternate use due to the stage of development. The $0.2 million of transaction costs incurred were recorded to acquired IPR&D expense. The assembled workforce asset recorded to intangible assets will be amortized over an estimated useful life of two years.

The contingent consideration of up to an additional $15 million relates to three future development milestones. The first milestone is the first product being approved for marketing by the FDA on or prior to December 31, 2021. If this milestone is met, the Company is required to make a milestone payment of $6 million. The second milestone is the second product being approved for marketing by the FDA on or prior to December 31, 2021. If this milestone is met, the Company is required to make a milestone payment of $5 million. The third milestone is a protide molecule being approved by the FDA on or prior to December 31, 2023. If this milestone is met, the Company is required to make a milestone payment of $4 million. All milestones are payable in either shares of the Company's common stock or cash, at the election of the Company.

The contingent consideration related to the development milestones will be recognized if and when such milestones are probable and can be reasonably estimated. As of March 31, 2019, no contingent consideration related to the development milestone has been recognized. The Company will continue to monitor the development milestones at each reporting period.

Avadel Pediatric Products Acquisition

On February 16, 2018, the Company entered into an Asset Purchase Agreement (the “Purchase Agreement”) with Avadel US Holdings, Inc., Avadel Pharmaceuticals (USA), Inc., Avadel Pediatrics, Inc., Avadel Therapeutics, LLC and Avadel Pharmaceuticals PLC (collectively, the “Sellers”) to purchase and acquire all rights to the Sellers’ pediatric products. Total consideration transferred to the Sellers consisted of: (1) a cash payment of one dollar, (2) the Company's assumption of existing seller debt due in January 2021 with a fair value of $15.1 million, and (3) contingent consideration relating to royalty obligations through February 2026 with a fair value at acquisition date of approximately $7.9 million. As a result of the Avadel pediatric products acquisition, the Company recorded goodwill of $3.8 million, which is deductible over 15 years for income tax purposes.

The transaction was accounted for as a business combination under the acquisition method of accounting. Accordingly, the tangible and identifiable intangible assets acquired and liabilities assumed were recorded at fair value as of the date of acquisition,

with the remaining purchase price recorded as goodwill. The goodwill recognized is attributable primarily to strategic opportunities related to an expanded commercial footprint and diversified pediatric product portfolio that is expected to provide revenue and cost synergies.

During the second quarter of 2018, the Company identified and recorded measurement period adjustments to the preliminary purchase price allocation. These adjustments are reflected in the tables below. The measurement period adjustments were the result of additional analysis performed and information identified during the second quarter of 2018 based on facts and circumstances that existed as of the purchase date. There were no additional measurement adjustments recorded in 2018.

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition and as adjusted for measurement period adjustments identified during the second quarter of 2018:

|

| | | | | | | | | | |

| | | | |

| | | | |

| | At February 16, 2018 (preliminary) | Measurement Period Adjustments | At February 16, 2018 (as adjusted) |

| | | | |

Inventory | | $ | 2,549,000 |

| $ | (1,831,000 | ) | $ | 718,000 |

|

Prepaid assets | | — |

| 570,000 |

| 570,000 |

|

Intangible assets | | 16,453,000 |

| 1,838,000 |

| 18,291,000 |

|

Accrued expenses | | — |

| (362,000 | ) | (362,000 | ) |

Fair value of debt assumed | | (15,272,303 | ) | 197,303 |

| (15,075,000 | ) |

Fair value of contingent consideration | | (7,875,165 | ) | (44,835 | ) | (7,920,000 | ) |

Total net liabilities assumed | | (4,145,468 | ) | 367,468 |

| (3,778,000 | ) |

Consideration exchanged | | 241,000 |

| (240,999 | ) | 1 |

|

Goodwill | | $ | 4,386,468 |

| $ | (608,467 | ) | $ | 3,778,001 |

|

The purchase price allocation related to the acquisition of Avadel's pediatric products was finalized in 2018. The fair values of intangible assets, including marketing rights, licenses, and developed technology, were determined using variations of the income approach. Varying discount rates were also applied to the projected net cash flows. The Company believes the assumptions are representative of those a market participant would use in estimating fair value. The fair value of intangible assets, both as of the date of acquisition and as adjusted by measurement period adjustments identified during the second quarter of 2018, includes the following:

|

| | | | | | | | | | | |

| | | | | |

| | | | | |

| | At February 16, 2018 (preliminary) | Measurement Period Adjustments | At February 16, 2018 (as adjusted) | Useful Life |

| | | | | |

Acquired Product Marketing Rights - Karbinal | | $ | 6,221,000 |

| $ | (21,000 | ) | $ | 6,200,000 |

| 10 years |

Acquired Product Marketing Rights - AcipHex | | 2,520,000 |

| 283,000 |

| 2,803,000 |

| 10 years |

Acquired Product Marketing Rights - Cefaclor | | 6,291,000 |

| 1,320,000 |

| 7,611,000 |

| 7 years |

Acquired Developed Technology - Flexichamber | | 1,131,000 |

| 546,000 |

| 1,677,000 |

| 10 years |

Acquired IPR&D - LiquiTime formulations | | 290,000 |

| (290,000 | ) | — |

| Indefinite |

Total | | $ | 16,453,000 |

| $ | 1,838,000 |

| $ | 18,291,000 |

| |

TRx Acquisition

On November 17, 2017, the Company entered into, and consummated the transactions contemplated by, an equity interest purchase agreement (the “TRx Purchase Agreement”) by and among the Company, TRx, Fremantle Corporation, and LRS International LLC, the selling members of TRx (collectively, the “TRx Sellers”), which provided for the purchase of all of the equity and ownership interests of TRx by the Company (the "TRx Acquisition"). The consideration for the TRx Acquisition consisted of $18.9 million in cash,

as adjusted for estimated working capital, estimated cash on hand, estimated indebtedness and estimated transaction expenses, as well as 7,534,884 shares of the Company’s common stock having an aggregate value on the closing date of $8.5 million (the "Equity Consideration") and certain potential contingent payments. Upon closing, the Company issued 5,184,920 shares of its common stock to the TRx Sellers. Pursuant to the TRx Purchase Agreement, the issuance of the remaining 2,349,968 shares was subject to the Company's stockholder approval. In May 2018, stockholder approval was obtained and the remaining shares were issued to the TRx Sellers. The contingent shares were initially recorded to contingently issuable shares, which is recorded within stockholder's equity and were reclassed to common stock and additional paid in capital upon issuance, on the consolidating balance sheet date. As a result of the TRx Acquisition, the Company has currently recorded goodwill of $12.6 million, of which $8.7 million was deductible for income taxes.

During the third quarter of 2018, the Company identified and recorded measurement period adjustments to our preliminary purchase price allocation that was disclosed in prior periods. These adjustments are reflected in the tables below. The measurement period adjustments were the result of an arbitration ruling discussed in further detail in Note 13, the facts and circumstances of which existed as of the acquisition date.

The following table summarizes the preliminary acquisition-date fair value of the consideration transferred at the date of acquisition both as disclosed in periods prior to the third quarter of 2018 and as adjusted for measurement period adjustments identified during the third quarter of 2018:

|

| | | | | | | | | | |

| | | | |

| | | | |

| | At November 17, 2017 (preliminary) | Measurement Period Adjustments | At November 17, 2017 (as adjusted) |

| | | | |

Cash | | $ | 18,900,000 |

| $ | — |

| $ | 18,900,000 |

|

Common stock (including contingently issuable shares) | | 8,514,419 |

| — |

| 8,514,419 |

|

Contingent payments | | 2,576,633 |

| (1,210,000 | ) | 1,366,633 |

|

Total consideration transferred | | $ | 29,991,052 |

| (1,210,000 | ) | 28,781,052 |

|

The TRx Acquisition was accounted for as a business combination under the acquisition method of accounting. Accordingly, the tangible and identifiable intangible assets acquired and liabilities assumed were recorded at fair value as of the date of acquisition, with the remaining purchase price recorded as goodwill. The goodwill recognized is attributable primarily to strategic opportunities related to leveraging TRx’s research and development, intellectual property, and processes.

The following table summarizes the preliminary fair values of the assets acquired and liabilities assumed at the date of acquisition both as disclosed in periods prior to the third quarter of 2018 and as adjusted for measurement period adjustments identified during the third quarter of 2018:

|

| | | | | | | | | | |

| | | | |

| | | | |

| | At November 17, 2017 (preliminary) | Measurement Period Adjustments | At November 17, 2017 (as adjusted) |

| | | | |

Fair value of assets acquired: | | | | |

Cash and cash equivalents | | $ | 11,068 |

| $ | — |

| $ | 11,068 |

|

Accounts receivable, net | | 2,872,545 |

| — |

| 2,872,545 |

|

Inventory | | 495,777 |

| — |

| 495,777 |

|

Prepaid expenses and other current assets | | 134,281 |

| — |

| 134,281 |

|

Other receivables | | — |

| 2,764,515 |

| 2,764,515 |

|

Identifiable Intangible Assets: | | | | — |

|

Acquired product marketing rights - Metafolin | | 10,465,000 |

| 1,522,000 |

| 11,987,000 |

|

PAI sales and marketing agreement | | 2,334,000 |

| 219,000 |

| 2,553,000 |

|

Acquired product marketing rights - Millipred | | 4,714,000 |

| 342,000 |

| 5,056,000 |

|

Acquired product marketing rights - Ulesfia | | 555,000 |

| (555,000 | ) | — |

|

Total assets acquired | | 21,581,671 |

| 4,292,515 |

| 25,874,186 |

|

| | | | |

Fair value of liabilities assumed: | | | | |

Accounts payable | | 192,706 |

| — |

| 192,706 |

|

Accrued expenses and other current liabilities | | 4,850,422 |

| 3,764,515 |

| 8,614,937 |

|

Deferred tax liability | | 839,773 |

| 78,840 |

| 918,613 |

|

Total liabilities assumed | | 5,882,901 |

| 3,843,355 |

| 9,726,256 |

|

Total identifiable net assets | | 15,698,770 |

| 449,160 |

| 16,147,930 |

|

Fair value of consideration transferred | | 29,991,052 |

| (1,210,000 | ) | 28,781,052 |

|

Goodwill | | $ | 14,292,282 |

| $ | (1,659,160 | ) | $ | 12,633,122 |

|

The purchase price allocation related to the acquisition of TRx was finalized in 2018. The fair values of intangible assets, including marketing rights, licenses and developed technology, were determined using variations of the income approach, specifically the multi-period excess earnings method. Varying discount rates were also applied to the projected net cash flows. The Company believes the assumptions are representative of those a market participant would use in estimating fair value. The final fair value of intangible assets both as disclosed in prior periods and as adjusted by measurement period adjustments identified during the third quarter of 2018 includes the following:

|

| | | | | | | | | | | |

| | | | | |

| | | | | |

| | At November 17,

2017 (preliminary) | Measurement Period Adjustments | At November 17, 2017 (as adjusted) | Useful Life |

| | | | | |

Acquired product marketing rights - Metafolin | | $ | 10,465,000 |

| $ | 1,522,000 |

| $ | 11,987,000 |

| 15 years |

PAI sales and marketing agreement | | 2,334,000 |

| 219,000 |

| 2,553,000 |

| 2 years |

Acquired product marketing rights - Millipred | | 4,714,000 |

| 342,000 |

| 5,056,000 |

| 4 years |

Acquired product marketing rights - Ulesfia | | 555,000 |

| (555,000 | ) | — |

| |

Total | | $ | 18,068,000 |

| $ | 1,528,000 |

| $ | 19,596,000 |

| |

The Company received written notice to terminate the PAI sales and marketing agreement in the second quarter of 2018. As a result, the Company reassessed the fair value of the PAI sales and marketing agreement on that date (a level III non-recurring fair value measurement) and concluded due to the absence of future cash flows beyond the date of termination that the fair value was $0. An

impairment charge was recognized in the second quarter of 2018 in the amount of $1.9 million, representing the remaining net book value of the PAI sales and marketing agreement intangible asset.

Pro Forma Impact of Business Combinations

The following supplemental unaudited pro forma information presents Cerecor’s financial results as if the acquisition of the Avadel pediatric products, which was completed on February 16, 2018, had occurred on January 1, 2018:

|

| | | |

| Three Months Ended |

| March 31, |

| 2018 |

| |

| |

Total revenues, net | $ | 6,187,775 |

|

Net loss | $ | (4,928,446 | ) |

Basic and diluted net loss per share of common stock | $ | (0.16 | ) |

Basic and diluted net loss per share of preferred stock | $ | — |

|

The above unaudited pro forma information was determined based on the historical GAAP results of Cerecor and Avadel's pediatric products. The unaudited pro forma consolidated results are provided for informational purposes only and are not necessarily indicative of what Cerecor’s consolidated results of operations would have been had the acquisition of Avadel's pediatric products been completed on the date indicated or what the consolidated results of operations will be in the future.

6. Fair Value Measurements

ASC No. 820, Fair Value Measurements and Disclosures (“ASC 820”), defines fair value as the price that would be received to sell an asset, or paid to transfer a liability, in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. The fair value standard also establishes a three‑level hierarchy, which requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The valuation hierarchy is based upon the transparency of inputs to the valuation of an asset or liability on the measurement date. The three levels are defined as follows:

| |

• | Level 1—inputs to the valuation methodology are quoted prices (unadjusted) for an identical asset or liability in an active market. |

| |

• | Level 2—inputs to the valuation methodology include quoted prices for a similar asset or liability in an active market or model‑derived valuations in which all significant inputs are observable for substantially the full term of the asset or liability. |

| |

• | Level 3—inputs to the valuation methodology are unobservable and significant to the fair value measurement of the asset or liability. |

The following table presents, for each of the fair value hierarchy levels required under ASC 820, the Company’s assets and liabilities that are measured at fair value on a recurring basis:

|

| | | | | | | | | | | | |

| | March 31, 2019 |

| Fair Value Measurements Using |

| Quoted prices in | | Significant other | | Significant |

| active markets for | | observable | | unobservable |

| identical assets | | inputs | | inputs |

| (Level 1) | | (Level 2) | | (Level 3) |

Assets | | | | | | |

Investments in money market funds* | | $ | 13,965,626 |

| | $ | — |

| | $ | — |

|

Liabilities | | | | | | |

Contingent consideration | | $ | — |

| | $ | — |

| | $ | 9,002,288 |

|

Warrant liability | | $ | — |

| | $ | — |

| | $ | 17,750 |

|

Unit purchase option liability | | $ | — |

| | $ | — |

| | $ | 39,993 |

|

|

| | | | | | | | | | | | |

| | December 31, 2018 |

| Fair Value Measurements Using |

| Quoted prices in | | Significant other | | Significant |

| active markets for | | observable | | unobservable |

| identical assets | | inputs | | inputs |

| (Level 1) | | (Level 2) | | (Level 3) |

Assets | | | | | | |

Investments in money market funds* | | $ | 7,324,932 |

| | $ | — |

| | $ | — |

|

Liabilities | | | | | | |

Contingent consideration | | $ | — |

| | $ | — |

| | $ | 9,050,564 |

|

Warrant liability** | | $ | — |

| | $ | — |

| | $ | 2,950 |

|

Unit purchase option liability** | | $ | — |

| | $ | — |

| | $ | 7,216 |

|

*Investments in money market funds are reflected in cash and cash equivalents on the accompanying condensed consolidated balance sheets.

**Warrant liability and unit purchase option liability are reflected in accrued expenses and other current liabilities on the accompanying condensed consolidated balance sheets.

As of March 31, 2019 and December 31, 2018, the Company’s financial instruments included cash and cash equivalents, restricted cash, accounts receivable, accounts payable, accrued expenses and other current liabilities, short term and long-term debt, warrant liability, the underwriters' unit purchase option liability, and contingent consideration. The carrying amounts reported in the accompanying condensed consolidated financial statements for cash and cash equivalents, restricted cash, accounts receivable, accounts payable, accrued expenses, and other current liabilities approximate their respective fair values because of the short-term nature of these accounts. The estimated fair value of the Company’s long-term debt of $14.9 million as of March 31, 2019 was based on current interest rates for similar types of borrowings and is in Level 2 of the fair value hierarchy.

Level 3 Valuation

The tables presented below are a summary of changes in the fair value of the Company’s Level 3 valuations for the warrant liability, unit purchase option liability, and contingent consideration for the three months ended March 31, 2019 and 2018:

|

| | | | | | | | | | | | | | | | |

| | Warrant | | Unit purchase | | Contingent | | |

| | liability | | option liability | | consideration | | Total |

Balance at December 31, 2018 | | $ | 2,950 |

| | $ | 7,216 |

| | $ | 9,050,564 |

| | $ | 9,060,730 |

|

Payment of contingent consideration | | — |

| | — |

| | (228,678 | ) | | (228,678 | ) |

Change in fair value | | 14,800 |

| | 32,777 |

| | 180,402 |

| | 227,979 |

|

Balance at March 31, 2019 | | $ | 17,750 |

| | $ | 39,993 |

| | $ | 9,002,288 |

| | $ | 9,060,031 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | Warrant liability | | Unit purchase option liability | | Contingent consideration | | Royalty Obligation | | Total |

Balance at December 31, 2017 | | $ | 8,185 |

| | $ | 26,991 |

| | $ | 2,576,633 |

| | $ | — |

| | $ | 2,611,809 |

|

Issuance of contingent consideration and royalty | | — |

| | — |

| | 7,875,165 |

| | 240,744 |

| | 8,115,909 |

|

Change in fair value | | 7,405 |

| | 15,846 |

| | 199,283 |

| | 63,486 |

| | 286,020 |

|

Balance at March 31, 2018 | | $ | 15,590 |

| | $ | 42,837 |

| | $ | 10,651,081 |

| | $ | 304,230 |

| | $ | 11,013,738 |

|

In 2014, the Company issued warrants to purchase 625,208 shares of convertible preferred stock. Upon the closing of our initial public offering ("IPO") in October 2015 these warrants became warrants to purchase 22,328 shares of common stock, in accordance with their terms. The warrants expire in October 2020. The warrants represent a freestanding financial instrument that is indexed to an obligation, which the Company refers to as the warrant liability. The warrant liability is marked-to-market each reporting period with the change in fair value recorded to other income, net in the accompanying statements of operations until the warrants are exercised, expire or other facts and circumstances lead the warrant liability to be reclassified to stockholders’ equity. The fair value of the warrant liability is estimated using a Black-Scholes option-pricing model. The significant assumptions used in preparing the option pricing model for valuing the warrant liability as of March 31, 2019, include (i) volatility of 50%, (ii) risk free interest rate of 2.33%, (iii) strike price $8.40, (iv) fair value of common stock $5.84, and (v) expected life of 1.60 years years.

The underwriters’ unit purchase option (the “UPO”) was issued to the underwriters of the Company's IPO in 2015 and provides the underwriters the option to purchase up to a total of 40,000 units. The units underlying the UPO will be, immediately upon exercise, separated into shares of common stock, underwriters’ Class A warrants, and underwriters’ Class B warrants (such warrants together referred to as the Underwriters’ Warrants). The Underwriters’ Warrants were warrants to purchase shares of common stock. The Class B warrants expired in April 2017 and the Class A warrants expired in October 2018, while the UPO expires in October 2020. The Company classifies the UPO as a liability, as it is a freestanding marked-to-market derivative instrument that is precluded from being classified in stockholders’ equity. The UPO liability is marked-to-market each reporting period with the change in fair value recorded to other income, net in the accompanying statements of operations until the UPO is exercised, expires or other facts and circumstances lead the UPO to be reclassified to stockholders’ equity. The fair value of the UPO liability is estimated using a Black-Scholes option-pricing model. The significant assumptions used in preparing the simulation model for valuing the UPO as of March 31, 2019, include (i) volatility of 50%, (ii) risk free interest rate of 2.33%, (iii) unit strike price $7.47, (iv) fair value of underlying equity $5.84, and (v) expected life of 1.6 years.

The Company's business acquisitions of Avadel's pediatric products and TRx (see Note 5) involve the potential for future payment of consideration that is contingent upon the achievement of operation and commercial milestones and royalty payments on future product sales. The fair value of contingent consideration was determined at the acquisition date utilizing unobservable inputs such as the estimated amount and timing of projected cash flows, the probability of success (achievement of the contingent event), and the risk-adjusted discount rate used to present value the probability-weighted cash flows. Subsequent to the acquisition date, at each reporting period, the contingent consideration liabilities are remeasured at the current fair value with changes recorded in the condensed consolidated statement of operations.

As part of the acquisition of Avadel's pediatric products, the Company will pay a 15% annual royalty on net sales of the acquired Avadel pediatric products through February 2026, up to an aggregate amount of $12.5 million. The fair value of the future royalty is the expected future value of the contingent payments discounted to a present value. The estimated fair value of the royalty payments as of March 31, 2019 was $7.7 million. The significant assumptions used in estimating the fair value of the royalty payment as of March 31, 2019 include (i) the expected net sales of the acquired Avadel pediatric products for that are subject to the 15% royalty based on the Company's net sales forecast and (ii) the risk-adjusted discount rate of 8.4%, which is comprised of the risk-free interest rate of 2.3% and a counterparty risk of 6.1% utilized to discount the expected royalty payments. The liability is reduced by periodic payments.

Additionally, as part of the initial purchase price allocation for the acquisition of Avadel's pediatric products performed during the first quarter of 2018, contingent consideration of $240,744 was assigned to future royalty obligations for the use of the Sellers' LiquiTime process technology. In the second quarter of 2018, we identified measurement period adjustments which included the adjustment of the fair value of the LiquiTime intangible asset down to $0.

The consideration for the TRx acquisition includes certain potential contingent payments. First, pursuant to the TRx Purchase Agreement, the Company would have been required to pay $3.0 million to the Sellers if the gross profit related to TRx products equaled or exceeded $12.6 million in 2018. The Company did not achieve this contingent event in 2018 and therefore no value was assigned to the contingent payout as of December 31, 2018. Additionally, the Company is required to pay $2.0 million upon the transfer of the Ulesfia

NDA to the Company ("NDA Transfer Milestone"). Finally, the Company will pay $2.0 million upon FDA approval of a new dosage of Ulesfia ("FDA Approval Milestone"). The main inputs utilized to determine the fair value of each milestone is the probability of the milestone's success, the expected time to successfully reach the milestone, and the risk-adjusted discount rate. The estimated fair value of the NDA Transfer Milestone as of March 31, 2019 was $0.9 million and the significant assumptions used in estimating the fair value include (i) probability of milestone success of 45.0%, (ii) expected time to milestone of 0.2 years, and (iii) risk-adjusted discount rate of 8.5%, which is comprised of the risk-free rate of 2.4% and a counterparty risk of 6.1%. The estimated fair value of the FDA Approval Milestone as of March 31, 2019 was $0.4 million. The significant assumptions used in estimating the fair value of the FDA Approval Milestone as of March 31, 2019 include (i) probability of milestone success at 22.5%, (ii) expected time to milestone of 1.3 years, and (iii) risk-adjusted discount rate of 8.4%, which is comprised of the risk-free rate of 2.3% and a counterparty risk of 6.1%.

No other changes in valuation techniques or inputs occurred during the three months ended March 31, 2019 and 2018. No transfers of assets between Level 1 and Level 2 of the fair value measurement hierarchy occurred during the three months ended March 31, 2019 and 2018.

7. Accrued Expenses and Other Current Liabilities

Accrued expenses and other current liabilities as of March 31, 2019 and December 31, 2018 consisted of the following:

|

| | | | | | | | |

| | As of |

| | March 31, 2019 | | December 31, 2018 |

Sales returns and allowances | | $ | 4,249,977 |

| | $ | 3,972,510 |

|

Medicaid rebates | | 2,758,384 |

| | 2,237,269 |

|

Minimum sales commitments, royalties payable, and purchase obligations | | 10,808,083 |

| | 9,662,901 |

|

Compensation and benefits | | 1,679,572 |

| | 1,953,065 |

|

Research and development expenses | | 1,123,051 |

| | 278,132 |

|

Sales and marketing | | 938,437 |

| | 1,112,378 |

|

General and administrative | | 187,465 |

| | 235,721 |

|

Other | | 70,128 |

| | 279,397 |

|

Total accrued expenses and other current liabilities | | $ | 21,815,097 |

| | $ | 19,731,373 |

|

8. Deerfield Obligation

In relation to the Company's acquisition of Avadel's pediatric products on February 16, 2018, the Company assumed an obligation that Avadel had to Deerfield CSF (the "Deerfield Obligation"). Beginning in July 2018 through October 2020, the Company is required to pay a quarterly payment of $262,500 to Deerfield. In January 2021, a balloon payment of $15,250,000 is due. The difference between the gross value and fair value of these payments will be recorded as interest expense in the Company's condensed consolidated statements of operations through January 2021 using the effective interest method. Interest expense for the three months ended March 31, 2019 was $0.2 million and is included in interest expense, net on the accompanying condensed consolidated statements of operations. The amounts due within the next year are included in current portion of long-term debt on the Company's condensed consolidated balance sheets. The amounts due in greater than one year are included in long-term debt, net of current portion, on the Company's condensed consolidated balance sheets. The Deerfield Obligation was $15.4 million as of March 31, 2019, of which $1.1 million is recorded as a current liability.

9. Capital Structure

According to the Company's amended and restated certificate of incorporation, the Company is authorized to issue two classes of stock, common stock and preferred stock. At March 31, 2019, the total number of shares of capital stock the Company was authorized to issue was 205,000,000 of which 200,000,000 was common stock and 5,000,000 was preferred stock. All shares of common and preferred stock have a par value of $0.001 per share.

On December 26, 2018, the Company filed a Certificate of Designation of Preferences of Series B Non-Voting Convertible Preferred Stock ("Series B Convertible Preferred Stock" or "convertible preferred stock") of Cerecor Inc. (the “Certificate of Designation of the Series B Preferred Stock”) classifying and designating the rights, preferences and privileges of the Series B Convertible Preferred Stock. The Certificate of Designation of the Series B Convertible Preferred Stock authorized 2,857,143 shares of convertible preferred stock. The Series B Convertible Preferred Stock converts to shares of common stock on a 1-for-5 ratio and has the same rights, preferences, and privileges as common stock other than it holds no voting rights.

Convertible Preferred Stock

December 2018 Armistice Private Placement

On December 27, 2018, the Company entered into a series of transactions as part of a private placement with Armistice in order to generate cash to continue to develop our pipeline assets and for general corporate purposes. The transactions are considered one transaction for accounting purposes. As part of the transaction, the Company exchanged common stock warrants issued on April 27, 2017 to Armistice for the purchase up to 14,285,714 shares of the Company’s common stock at an exercise price of $0.40 per share (the "original warrants") for like-kind warrants to purchase up to 2,857,143 shares of the Company's newly designated Series B Convertible Preferred Stock with an exercise price of $2.00 per share (the "exchanged warrants"). Armistice immediately exercised the exchanged warrants and acquired an aggregate of 2,857,143 shares of the convertible preferred stock. Net proceeds of the transaction were approximately $5.7 million for the year ended December 31, 2018.

In order to provide Armistice an incentive to exercise the exchanged warrants, the Company also entered into a securities purchase agreement with Armistice pursuant to which the Company issued warrants for 4,000,000 shares of common stock of the Company with a term of 5.5 years and an exercise price of $12.50 per share (the "incentive warrants"). For accounting purposes, the Company calculated the fair value of the incentive warrants of $1.7 million, which was considered a deemed distribution to Armistice for the year ended December 31, 2018.

Voting

Holders of the Company's convertible preferred stock are not entitled to vote.

Dividends

The holders of convertible preferred stock are entitled to receive dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

Liquidation

In the event of the Company’s liquidation, dissolution or winding up, holders of the Company’s convertible preferred stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all debts and other liabilities.

Rights and Preferences

Each share of convertible preferred stock converts to shares of common stock on a 1-for-5 ratio. There are no other preemptive or subscription rights and there are no redemption or sinking fund provisions applicable to the Company’s common stock.

Common Stock

Common Stock Offering

On March 8, 2019, the Company closed on an underwritten public offering of common stock for 1,818,182 shares of common stock of the Company, at a price to the public of $5.50 per share. Armistice participated in the offering by purchasing 363,637 shares of common stock of the Company from the underwriter at the public price. The gross proceeds to the Company, before deducting underwriting discounts and commissions and offering expenses, were approximately $10.0 million. The net proceeds were approximately $9.0 million.

December 2018 Armistice Private Placement

As discussed in detail above, on December 27, 2018 the Company exchanged previously outstanding warrants for like-kind warrants for 2,857,143 shares of the Company's convertible preferred stock with an exercise price of $2.00 per share. Armistice immediately exercised these warrants for 2,857,143 shares of convertible preferred stock for net proceeds to the Company of $5.7 million. The convertible preferred stock converts to common stock on a 1-for-5 ratio (or to 14,285,714 shares of common stock in total). Additionally, on December 27, 2018, in order to provide Armistice an incentive to exercise the exchanged warrants, the Company entered into a securities purchase agreement with Armistice pursuant to which the Company issued warrants for 4,000,000 shares of common

stock of the Company with a term of 5.5 years and an exercise price of $12.50 per share (the "incentive warrants"). See "December 2018 Armistice Private Placement" above for more details.

August 2018 Armistice Private Placement

On August 17, 2018, the Company entered into a securities purchase agreement with Armistice, pursuant to which the Company sold 1,000,000 shares of the Company’s common stock, $0.001 par value per share for a purchase price of $3.91 per share, which was the closing price of shares of the Common Stock on August 16, 2018. Net proceeds of this securities purchase agreement were approximately $3.9 million.

Ichorion Asset Acquisition

On September 25, 2018, under the terms of the Ichorion Asset Acquisition noted above in Note 5, the Company issued 5.8 million common stock shares upon closing.

Contingently Issuable Shares

Under the terms of TRx acquisition noted above in Note 5, the Company was required to issue common stock having an aggregate value as calculated in the TRx Purchase Agreement on the Closing Date of $8.1 million (the “Equity Consideration”). Upon closing, the Company issued 5,184,920 shares of its common stock. Pursuant to the TRx Purchase Agreement, the issuance of the remaining 2,349,968 shares as a part of the Equity Consideration was subject to stockholder approval at the Company's 2018 Annual Stockholder's Meeting. This approval was obtained in May 2018 and the remaining shares were issued to the TRx Sellers.

Voting

Common stock is entitled to one vote for each share held of record on all matters submitted to a vote of the stockholders, including the election of directors, and does not have cumulative voting rights. Accordingly, the holders of a majority of the shares of common stock entitled to vote in any election of directors can elect all of the directors standing for election.

Dividends

The holders of common stock are entitled to receive dividends, if any, as may be declared from time to time by the board of directors out of legally available funds.

Liquidation

In the event of the Company’s liquidation, dissolution or winding up, holders of the Company’s common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all debts and other liabilities.

Rights and Preferences

Holders of the Company’s common stock have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to the Company’s common stock.

Common Stock Warrants

At March 31, 2019, the following common stock warrants were outstanding:

|

| | | | | | |

Number of shares | | Exercise price | | Expiration |

underlying warrants | | per share | | date |

22,328* | | $ | 8.40 |

| | October 2020 |

2,380* | | $ | 8.68 |

| | May 2022 |

4,000,000 | | $ | 12.50 |

| | June 2024 |

4,024,708 | | | | |

| | | | |

*Accounted for as a liability instrument (see Note 6) | | | | |

10. Stock-Based Compensation

2016 Equity Incentive Plan

On April 5, 2016, the Company’s board of directors adopted the 2016 Equity Incentive Plan (the “2016 Plan”) as the successor to the 2015 Omnibus Plan (the “2015 Plan”). The 2016 Plan was approved by the Company’s stockholders and became effective on May 18, 2016 (the “2016 Plan Effective Date”).

Upon the 2016 Plan Effective Date, the 2016 Plan reserved and authorized up to 600,000 additional shares of common stock for issuance, as well as 464,476 unallocated shares remaining available for grant of new awards under the 2015 Plan. An Amended and Restated 2016 Equity Incentive Plan (the "2016 Amended Plan") was approved by the Company's stockholders in May 2018, which increased the share reserve by an additional 1.4 million shares. During the term of the 2016 Amended Plan, the share reserve will automatically increase on the first trading day in January of each calendar year, by an amount equal to 4% of the total number of outstanding shares of common stock of the Company on the last trading day in December of the prior calendar year. As of March 31, 2019, there were 2.1 million shares available for future issuance under the 2016 Amended Plan.

Option grants to employees and directors typically expire after ten years. Employee options with service based vesting conditions typically vest over three or four years. Options granted to directors typically vest over three years. Directors may also elect to receive stock options in lieu of cash board compensation, which vest immediately. For stock options granted to employees and non-employee directors, the estimated grant date fair market value of the Company’s stock-based awards is amortized ratably over the individuals’ service periods, which is the period in which the awards vest. Stock-based compensation expense includes expense related to stock options, restricted stock unit awards, and ESPP shares. The amount of stock-based compensation expense recognized for the three months ended March 31, 2019 and 2018 was as follows:

|

| | | | | | | | |

| | Three Months Ended March 31, |

| | 2019 | | 2018 |

Research and development | | $ | 57,376 |

| | $ | 11,497 |

|

General and administrative | | 489,953 |

| | 207,382 |

|

Sales and marketing | | 49,364 |

| | 23,945 |

|

Total stock-based compensation | | $ | 596,693 |

| | $ | 242,824 |

|

Stock options with service-based vesting conditions

The Company has granted awards that contain service-based vesting conditions. The compensation cost for these options is recognized on a straight-line basis over the vesting periods. A summary of option activity for the three months ended March 31, 2019 is as follows:

|

| | | | | | | | | | | | | |

| | Options Outstanding |

| | Number of shares | | Weighted average exercise price | | Grant date fair value of options | | Weighted average remaining contractual term (in years) |

Balance at December 31, 2018 | | 3,746,597 |

| | $ | 4.16 |

| |

|

| | 7.79 |

Granted | | 134,379 |

| | $ | 4.78 |

| | $ | 334,624 |

| |

|

Exercised | | (31,288 | ) | | $ | 3.01 |

| | | | |

Forfeited | | (4,383 | ) | | $ | 4.25 |

| | $ | 11,297 |

| |

|

Balance at March 31, 2019 | | 3,845,305 |

| | $ | 4.19 |

| |

|

| | 7.61 |

Exercisable at March 31, 2019 | | 2,269,081 |

| | $ | 4.56 |

| |

|

| | 6.76 |